Source: LSEG Data & Analytics, 1 November 2023

Market insights

2 min read

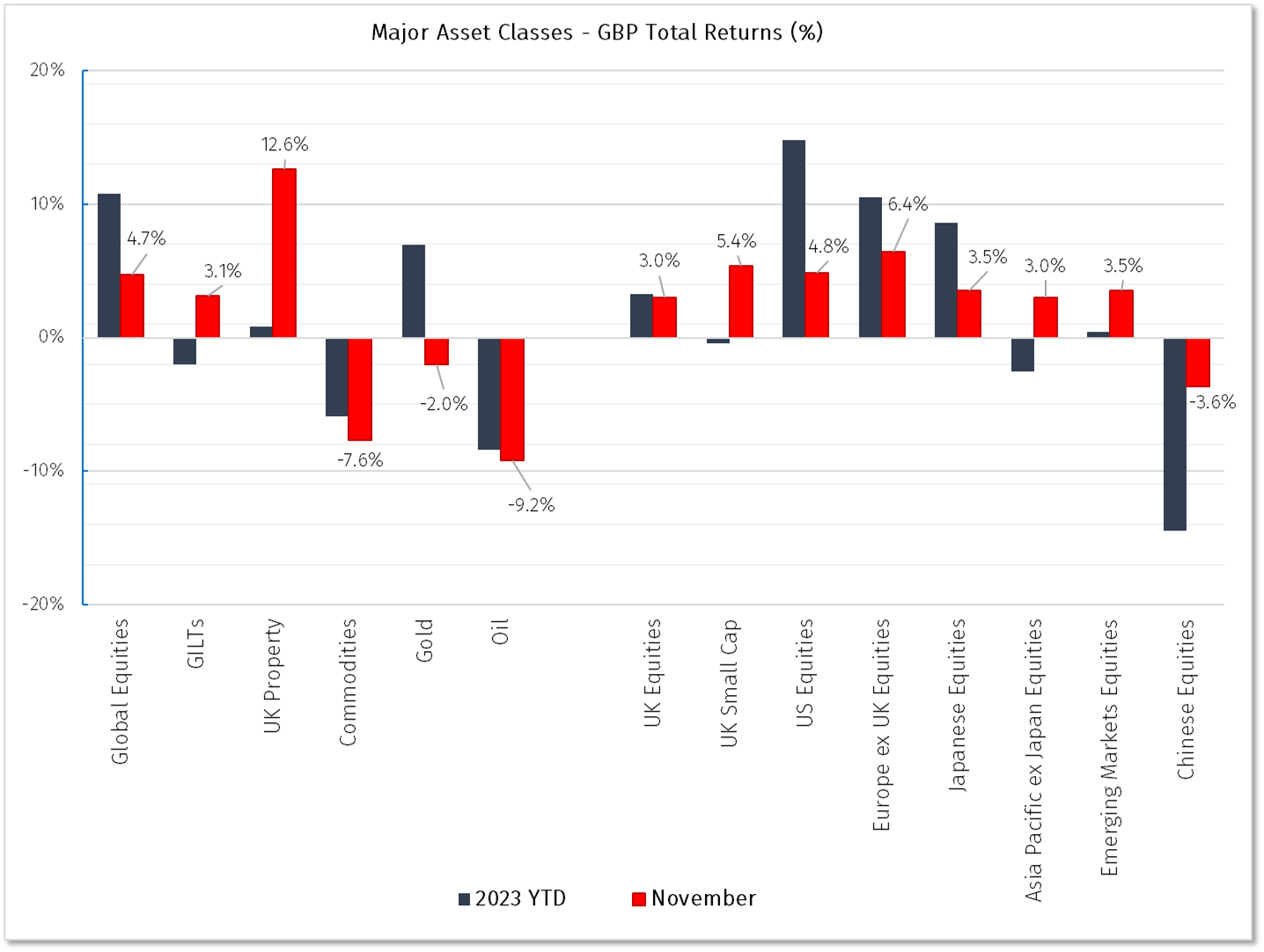

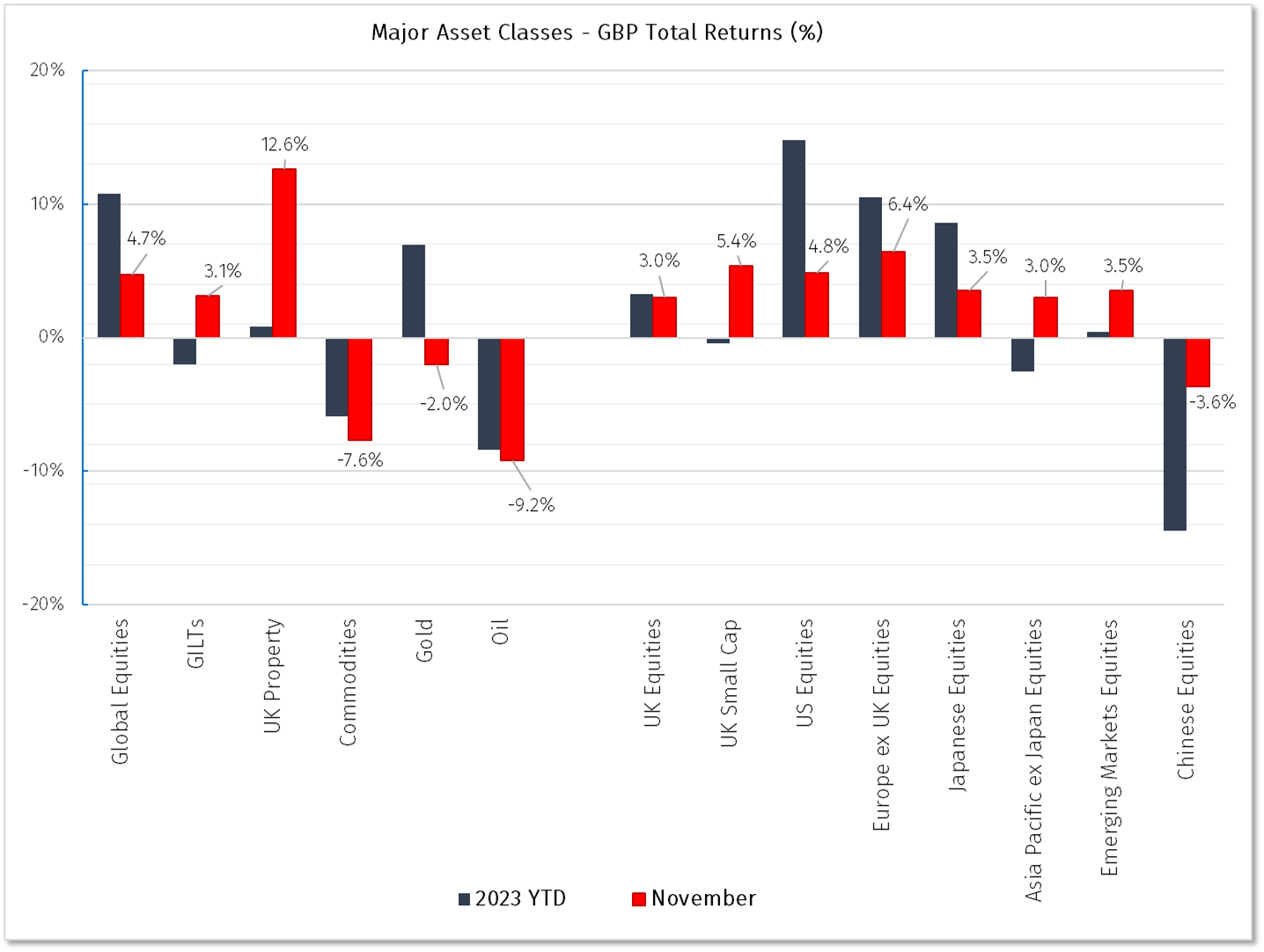

Risk assets rallied strongly in November as markets reacted positively to continued disinflation and a growing consensus for rate cuts early in 2024.

Source: LSEG Data & Analytics, 1 November 2023

Following three months of consecutive drawdowns, global equities had their best month of the year, returning 4.7% in sterling terms. European equities were the best regional performers following a steeper than expected drop in inflation. More broadly, growth equities and smaller companies performed well, as investors became more confident that the peak of the current tightening cycle has been reached.

The positive mood was also felt across other highly interest rate sensitive asset classes including property and broader real asset investment trusts. The UK REIT index returned 12.6% for the month, which put the sector back into positive territory for the year for the first time since February.

Government bond yields declined, with the UK 10-Year Gilt yield falling 36bps to 4.14% at the end of the month. At the time of writing, the Gilt Yield has fallen further, below 4%, which is the lowest level since Q1 2023. The US 10-year Treasury yield fell to 4.3% by the end of November and has since also fallen below 4%.

Commodities were an outlier across asset classes during the month, with the GSCI commodities index contracting from October peaks. Brent crude has slid back below $80 a barrel on concerns of a weak economic outlook, high US supply and investor scepticism of OPEC+ cuts. The gold price was down 2% for the month in sterling terms, over a month where pound sterling strengthened vs the dollar by 4.3%.

Although the recent broadening of returns across markets and sectors is a healthier development compared to the narrow sector leadership we saw in the first half of 2023, we continue to believe it prudent to consider risks that may be underappreciated by the market. As we look forward, there remains several plausible economic scenarios and although weakening economic data has so far been shrugged off by equity markets, we remain cautious on the impact of recent monetary tightening as it works its way through the financial system.

In the current environment we retain a view that diversification that considers a range of possible scenarios is the most sensible approach. We also believe it is important to give thought to market conditions over different time frames when considering risk management and asset allocation. While consensus is for inflation to continue to cool over the near-term, we still see a benefit of holding assets with inflation protection from a diversification perspective and believe there is a higher probability of inflation volatility on a longer-term view than is currently priced in. Over the shorter-term, where we believe there may be complacency within risk assets for anything other than a soft-landing, we believe it is sensible to balance offence with defence. Within fixed income, we continue to see value in gilts and have recently become more positive on gradually increasing our duration risk, locking in attractive yields for longer. We remain neutral in equities, with broadening positive momentum contrasting with a more cautious view on growth.

Despite a cautious stance, from an investment selection perspective we continue to see pockets of the market at what we view to be attractive valuations, particularly within the investment trust space. Discounts across the sector remain at extremes and a combination of easing interest rate pressure and the pick-up in corporate activity should provide positive tailwinds through 2024. Momentum in corporate activity continued in November with the announcement of another two proposed investment trust mergers and several strategic reviews put forward. The increasing prominence of activists within the sector is another indication that there is value on offer and will likely be an additional catalyst to unlock this over future months.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.