During the month, economic data presented mixed results, with global growth showing resilience despite higher rates. Headline inflation rates have broadly moved lower but core inflation remaining sticky has been a concern for central banks. Elevated core inflation measures have prevented central banks from moving away from a hawkish rhetoric, despite an expectation of the recent banking crisis contributing to tighter financial conditions.

Following the banking sector issues in March, many banks have bolstered liquidity, but moderate credit tightening appears likely, particularly for smaller institutions. Though concerns on contagion and broader issues with vulnerable banks eased throughout April, they re-emerged towards the end of the month with First Republic Bank being the latest casualty. The bank was subsequently acquired by JP Morgan in a deal brokered by US regulators.

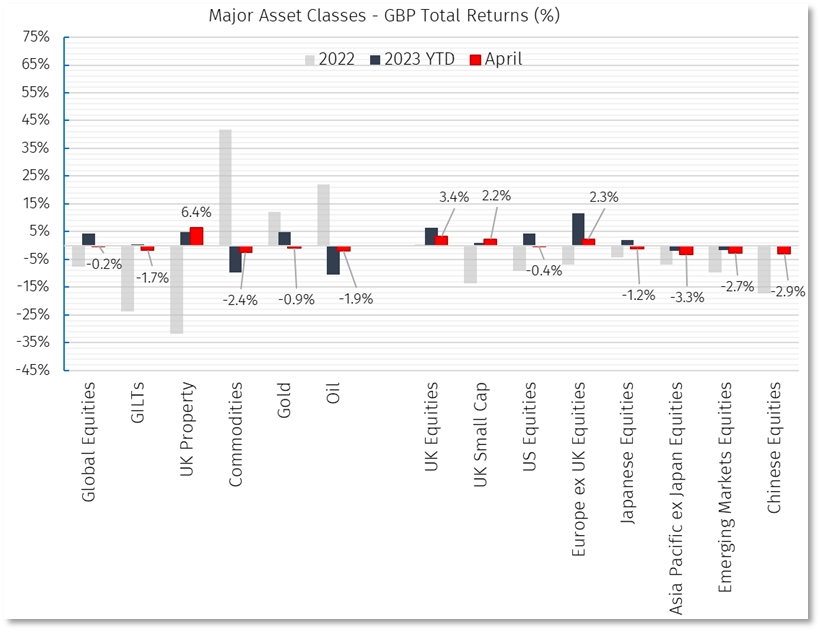

While pockets of data remain strong, risks to global economies still exist. The likelihood of lagged effects of rate hikes and banking strains amplifying the tightening of credit conditions remain high. Moreover, many equity markets, particularly the US, remain historically expensive and do not seem to be pricing in recession risk. Additionally, credit spreads remain relatively tight within fixed income. With lower risk options, including short-dated gilts, now offering a reasonable return again, we believe a balanced approach which includes defensive allocations is prudent in this environment. Select alternative assets can also play a role for inflation protection and for providing uncorrelated returns.