Global Market Review – August 2023

Market insights

6 min read

Global Market Review – August 2023

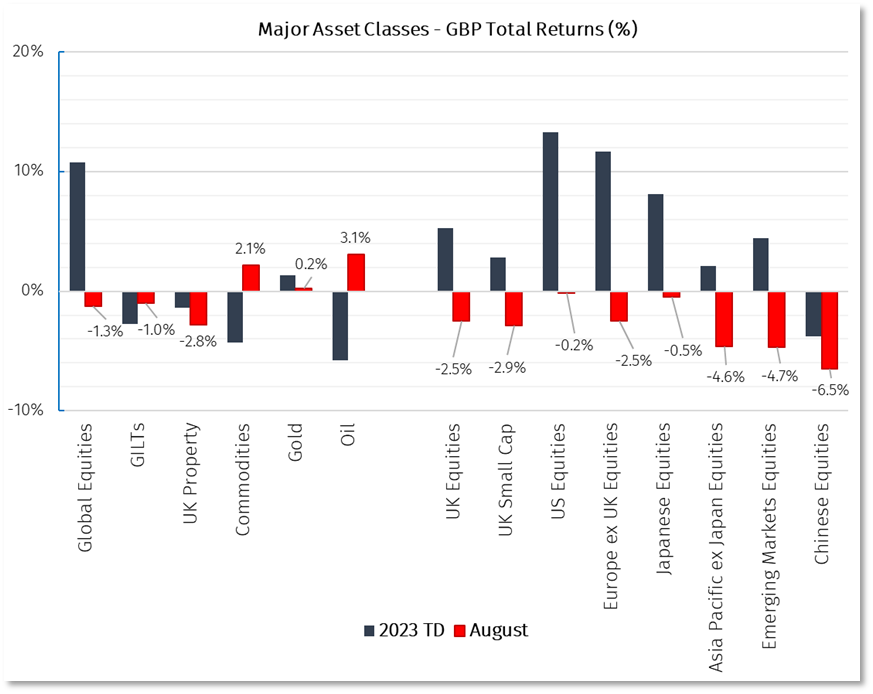

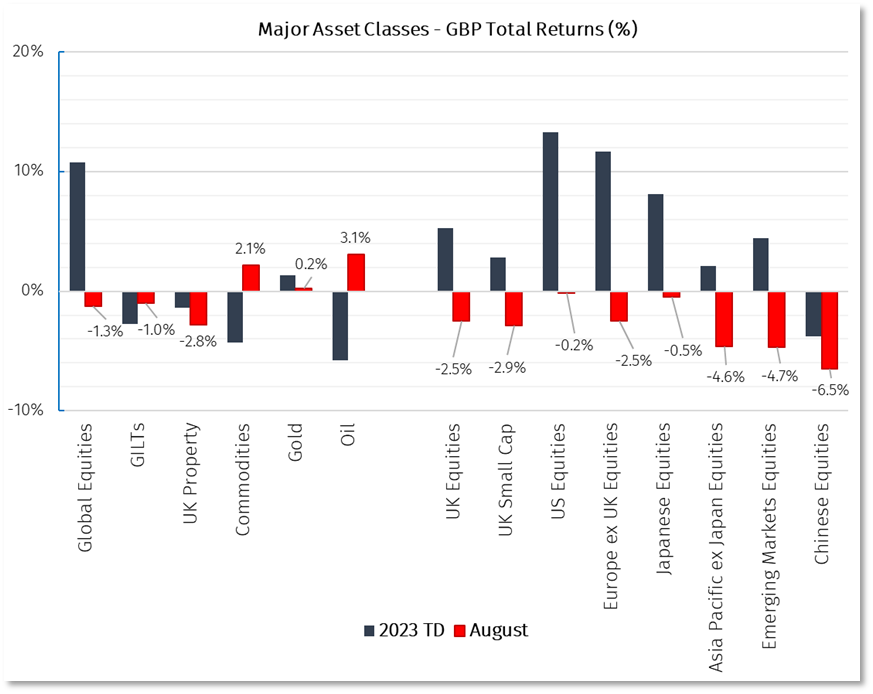

In August we observed a more volatile month for equity markets with global equities breaking a three-month streak of positive returns and ending the month down 1.3%. This did follow a recovery from a 4.6% drawdown mid-month, perhaps indicating that support remains. Key themes over the month included deteriorating global economic conditions, continued disinflation coupled with stubborn core inflation, and reiterations from key central banks that policy is set to remain restrictive.

Chinese equities saw the largest detraction for the month following continued weak economic data, which put pressure on the Asia Pacific and emerging markets indices. Aside from the ongoing property crisis, further evidence of deflation, weak industrial production data, and record levels of youth unemployment have all played a role in the continued negative sentiment in China. In response, the People’s Bank of China (PBOC) lowered its interest rate and authorities also looked to support markets by lowering stamp duty on stock investments. So far, this has been insufficient to restore confidence and stabilise negative sentiment.

Gilts and UK property also ended the month in negative territory, while the commodities index was supported by strength in the oil price. Brent crude is now above 20% from the June yearly lows and back above $90 a barrel following cutbacks in production by Saudia Arabia and Russia. With a high correlation between the oil price and inflation expectations, central banks and investors will be watching this closely.

August started and ended with some concerns for the U.S. At the beginning of the month ratings agency Fitch downgraded the U.S. government’s credit rating from the top level of AAA to a notch lower at AA+. The downgrade reflected concerns about the growth of the government's debt and the ability of Congress and the administration to control spending. Although there was no immediate impact on treasury yields, the downgrade has called more attention to the government’s fiscal and governance challenges. On the other side of the world the BRICS (Brazil, Russia, India, China, and South Africa) bloc met for its annual leader's summit on 22nd August and announced an extension of membership invitations to six other countries: Saudi Arabia, the United Arab Emirates, Iran, Egypt, Ethiopia, and Argentina. The inclusion of four Middle Eastern countries in the alliance suggests a diminishing U.S. influence in the region, with Saudi Arabia, Iran and UAE important entrants as major oil producers. The BRICS alignment stands as a substantial alternative to the G7 and is poised to shape a defining geopolitical bipolar power battle over the coming years.

In the current environment we retain a view that diversification that considers possible scenarios is the most sensible approach. We believe it is important to give thought to market conditions over different time frames when considering risk management and asset allocation. While consensus is for inflation to continue to cool over the near-term, we still see a benefit of holding assets with inflation protection from a diversification perspective and believe there is a higher probability of inflation volatility on a longer-term view than is currently priced in. Over the shorter-term, where we believe there may be complacency within risk assets for anything other than a soft-landing, we believe it is sensible to balance offence with defence. Within fixed income, we continue to see value in gilts and have recently become more positive on gradually increasing our duration risk, locking in attractive yields for longer. We remain neutral on equities but see opportunities in smaller companies and through investment trusts that are offering double discounts at both vehicle and underlying portfolio valuation levels.

The increase in corporate activity in the investment trust sector continued through August as boards respond to shareholder pressure to act on the sharp widening of share price discounts. The month saw the announcements of two proposed mergers, a wind-up, and several strategic reviews. We expect to see more activity over the coming months and view this as a positive and necessary step to unlock value and for the health of the sector.

UK

The UK equity market saw declines across all sectors other than energy over August, closing the month down 2.5%. Shell (+3.0%) and BP (+2.11%) were leading contributors as large positions in the index. Financial services was the leading detractor across sectors with Prudential (-10.7%) a notable underperformer. Sentiment on the latter has been impacted by China’s economic woes, with around 50% of the group's projected new business coming from Hong Kong and China.

Year over year headline inflation fell to 6.8% in July while core inflation remains at 6.9%, both of which remain uncomfortably high for the Bank of England. As expected, the Bank of England increased its base rate by 25bps, to 5.25%, with further hikes likely ahead. Economic growth continues to slow, and the Composite PMI fell to its lowest level in over 2 years. Data released during the month also provided further evidence that the labour market is beginning to show cracks, with the unemployment rate moving up to 4.2% in June.

Europe

The 2.5% monthly drawdown in European equities was largely driven by cyclicals and technology. Shares in Dutch payments processor Adyen NV were the leading detractor, falling 54.3% on weak earnings. ASML (-6.6%) and LVMH (-7.8%) were also notable detractors as large constituents of the index, the latter seeing pressure as luxury-goods stocks slumped across the board amid a deteriorating European economy and fear of a China spending slowdown.

European macroeconomic data continued to show signs of weakness and tightening credit conditions. The Composite PMI fell further into contraction territory (46.7) in August, raising concerns on recession risk. With inflation unexpectedly remaining flat at 5.3% year on year, the markets continue to price further ECB rate increases over coming months despite the deteriorating economy.

US

Dollar strength supported US equity returns for sterling investors with the US market close to flat for the month (-1.7% in dollar returns). There were no significant sector movements during the month.

Investors directed their attention towards the Jackson Hole Symposium, during which major central banks discussed monetary policy and the future of their economies. Federal Reserve Chair Jerome Powell noted that although core goods inflation has fallen sharply and price pressures in housing services should continue to cool as new rents are factored into inflation metrics, labour market tightness is keeping prices in non-housing services from cooling further. Inflation remains above target, with headline inflation at 3.2% and core inflation at 4.7%. U.S economic data throughout the month painted a mixed picture as job openings and new jobs both decreased while consumer spending remained resilient.

Japan

The TOPIX was close to flat in August. Sentiment has cooled shorter-term, but the country remains one of the leading performers YTD as positive developments with corporate governance improvements taking effect. Technology saw broad profit taking (detracting 0.7% from the index), while other sectors were close to flat. The economy grew by 6.0% quarter on quarter in Q2 2023 and the slight adjustment to BOJ (Bank of Japan) policy is yet to cause any market disorder, with the 10-year government bond yield only moving around 20bps higher.

Asia ex Japan and Emerging Markets

Investor sentiment in China remains challenging and the equity market gave back gains from the recent recovery, falling 6.5% over the month. China's economic challenges persist as the real estate sector came close to a second major default, this time from property development company Country Garden. The company has dodged a default so far, but upcoming debt payments have stirred worries. Despite expectations of a rebound in consumer spending following the easing of COVID-19 lockdown restrictions and tourist travel regulations, spending in China has also remained uninspiring. Domestic demand in ASEAN countries and wider emerging markets has held up better and inflation has returned to central bank targets in most countries.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.