UK

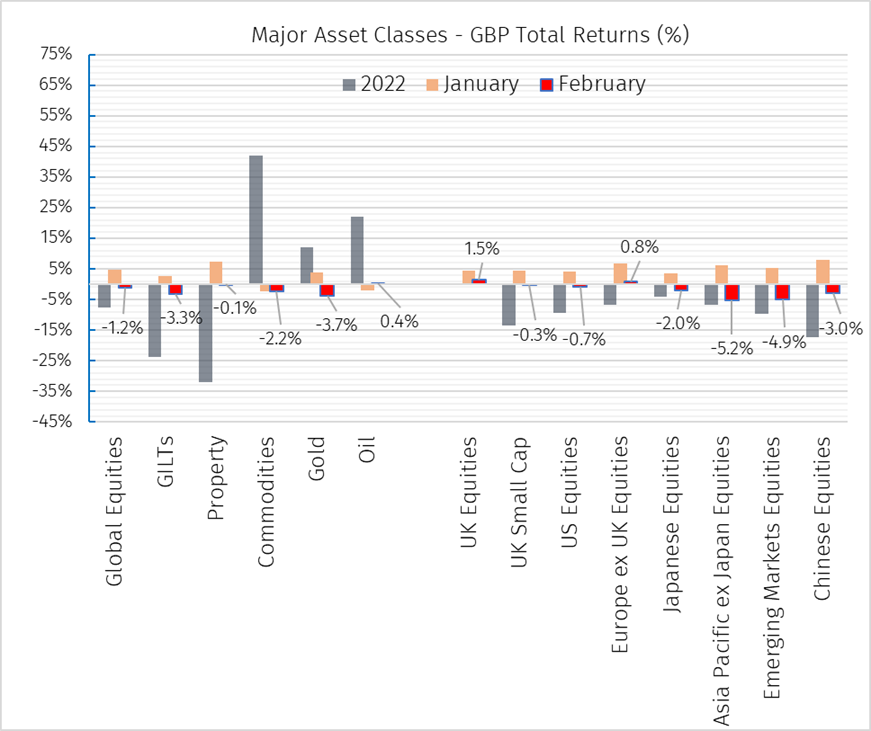

UK Equities were one of few markets delivering positive performance over the month. The FTSE 100 hit a record high during February, briefly hitting 8,000. The market was led by energy, financial services and healthcare. Materials was the only sector that saw a detraction as mining companies suffered from cooling commodity prices. Domestically focused areas of the market performed well as GDP data proved resilient and revealed that the UK economy had not contracted in Q4 2022.

In line with expectations, the Bank of England raised rates by 50bps to 4% at the beginning of the month. The tone of the statement was relatively dovish, with Bank of England governor Andrew Bailey commenting that inflation has turned a corner. Despite this, inflation currently remains at high levels and fell slightly from 10.5% to 10.1% from December to January.

Europe

European equities gained slightly in February despite growing concerns that the European Central Bank (ECB) will have to be more aggressive with monetary policy to quell rising inflation. Financial services and industrials marginally outperformed with most other sectors close to flat for the month. Markets had interpreted signs of cooling inflation in January as meaning that the pace of hikes could soon moderate. However, preliminary data for February indicated that inflation ticked up again in both Spain and France. The ECB raised interest rates by a further 50bps to 3.0% in February, with a further increase expected in March.

US

US Equities declined over the month with the majority of sectors detracting. Healthcare and energy were among the largest fallers. Technology was a notable outlier, with megacap companies including NVIDIA, Apple and Meta performing well, the former having posted strong results and announcing greater involvement with artificial intelligence.

At the beginning of the month Fed Chair Jerome Powell stated that there had been some encouraging signs that price pressures were easing. However, following stronger economic data later in the month, Powell warned that the process of disinflation is likely to have a long way to go, and further rate hikes are likely needed, particularly if macro data continues to come in stronger than expected. Strong economic data on growth and inflation released later in February indicated the US economy is currently experiencing a strong labour market, robust economic growth, and stickier than expected inflation. This was shown by stronger than expected retail sales for the month of January and 500,000 new jobs created over the period. The Federal Reserve’s preferred inflation gauge unexpectedly increased in January. The personal consumption expenditures price index rose 5.4% from a year earlier and the core metric was up 4.7%, both marking pickups after several months of declines.

Japan

The Japanese stock market declined 2% in sterling terms over February. The total return was 0.9% in local terms. The yen slipped to a two-month low at the end of the month, weighed down by a signal to continue monetary easing from the nominee for new Bank of Japan governor, as well as the strong U.S. inflation data. The decision to nominate Kazuo Ueda, an economics professor and former policy board member of the BoJ, surprised the market with the consensus expectation that the role would go to Masayoshi Amamiya, the current deputy governor (who declined the position). Inbound tourism has been sharply recovering. The number of foreign visitors in January was back to 60% of the pre-Covid period. Strong demand boosted company sales in retail, hotels and services sectors, which was demonstrated in the Q4 earnings results for domestic companies. Inflation in Japan has been creeping up and CPI was recorded at 4.3%, the highest level in the last 40 years.

Asia ex Japan and Emerging Markets

Asia ex Japan and emerging market equities saw sharp declines, mainly driven by China and Hong Kong as the boost from re-opening China’s economy faded following a strong start to the year. A re-escalation in US-China tensions also weighed on sentiment following the downing of a Chinese high-altitude balloon in US airspace. Malaysia and South Korea experienced sharp falls as investors took profits following a strong performance in January on investor optimism sparked by China’s reopening. Indian equities were also weaker in February, with domestic inflation numbers a concern.

Colombia was the weakest country in the emerging markets index as the country saw widespread protests against the government’s reforms. Thailand and Brazil also both underperformed too. The former saw Q4 GDP growth come in lower than expected while exports contracted given weak global demand. In Brazil, uncertainty about China’s recovery weighed on returns.

Fixed Interest

Global government bond yields broadly increased in February. 2-year and 10-year gilt yields increased by 63bps and 53bps respectively. Risk assets performed poorly with credit spreads widening as markets anticipated higher rates for longer. The US underperformed while European credit fared better.

Property and Alternatives

Real Estate Investment Trusts (REITs) and the performance of wider real assets was mixed over the month with the majority of assets seeing negative returns as the headwind of rising bond yields returned. Commodities recorded a negative performance in February. Industrial metals and precious metals were the worst-performing components of the index and energy prices were also weaker. Within industrial metals, nickel, zinc and aluminium all saw sharp price falls and within precious metals, silver and gold prices both declined in the month.

Past performance is not a reliable indicator of future performance. The value of investments could fall as well as rise and you might get back less than you invest.