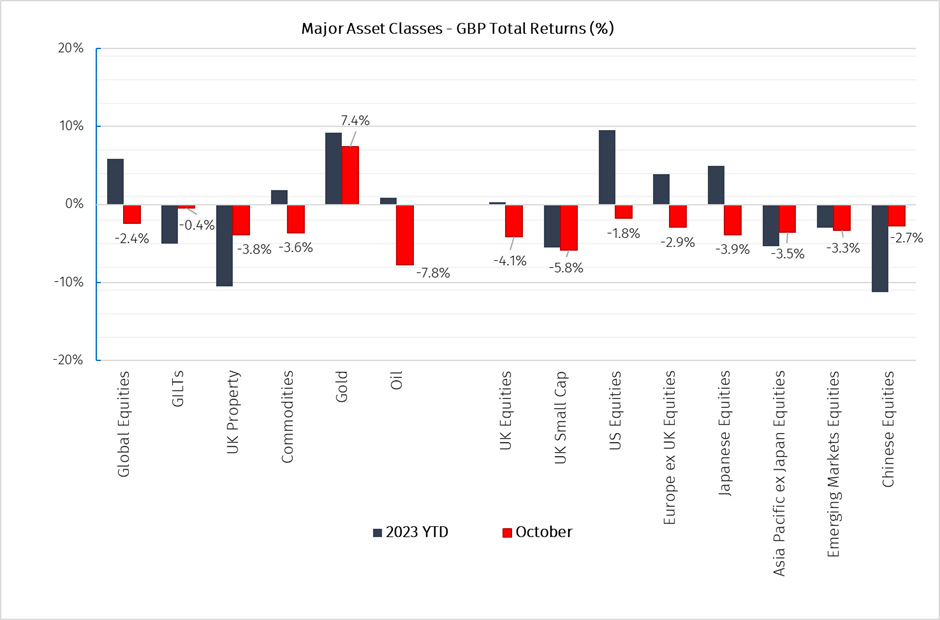

As with previous months, the largest mega-cap companies continued to buoy the overall narrowly led market, both in the US and globally. In fixed income, there was a further steepening in government bond yields, with the US 10-year treasury yield temporarily tipping 5%. The ECB paused interest rate hikes amid signs of inflation abating, with similar pauses widely expected for the US and UK. UK Gilts continued their sluggish performance, falling 0.4% over the month and remaining a major fixed income laggard year to date, with the UK’s inflation level remaining elevated relative within developed economies. Wider interest rate sensitive sectors, including UK listed REITs, saw negative share price total returns in October, and the UK commercial sector continues to trade on a wide discount vs its historical average (currently 26%). Generally, we saw a dampening of investor risk appetite as the market digests the ‘higher for longer’ rates narrative and geopolitical events in the Middle East.

Global Market Review – October 2023

Market insights

5 min read

Global Market Review – October 2023

Global equity markets continued a downward trend in October, with the MSCI All Country World Index returning -2.4%.

Source: LSEG Data & Analytics, 1 November 2023

In equities, US corporate earnings generally act as a barometer for wider developed markets, and third quarter results announced towards the end of October came as a positive surprise with a blended year-on-year growth rate of 2.8%. This was above analyst consensus expectation of a 0.3% decline. It is important to note that this was accompanied by widespread weaker fourth quarter guidance and concerns that 2024 could still prove challenging with continued higher interest rates limiting consumer demand and leading to an overall deterioration in credit.

It seems that far too recently we were commenting on the harrowing humanitarian disasters in Ukraine at the outset of the 2022 Russian invasion, and now similar sentiment is shared amidst ongoing events in Israel and Gaza. While the human impact is quite rightly the primary concern in this scenario, as investors, we must also consider the effects that events have on financial markets and clients’ portfolios. The initial outbreak was met with spikes in volatility, leading to stocks falling, with gold being the notable outperformer as investors sought out the perceived safe haven. Energy prices saw short term uplifts but have since been contained, with the oil price even depreciating by almost 8% in GBP terms by the end of the month. A key market concern remains that there is an escalation and other countries are pulled into the conflict, resulting in further supply side pressures and an increase in risk-off sentiment.

With question marks remaining on inflation, the outlook for growth and increasing geopolitical tensions, we believe that a range of outcomes remain possible over the medium term and portfolios should be constructed with different risks in mind. Our base case is for inflation to continue to cool near term as policy remains restrictive and lag effects feed through economies. On a longer-term view we see a higher risk of inflation volatility than what is currently is priced-in to markets. We maintain a view that this is an environment that warrants defensive tilts, and the recent return of equity-bond correlation further highlights the appeal of incorporating exposure to commodities and uncorrelated strategies as part of a diversified portfolio. Despite a cautious stance, we believe volatility and dislocations within asset classes are generating relative value opportunities for investors, particularly within the investment trust sector, fixed income markets and across smaller companies.

UK

At -4.1%, UK equities performed the worst among their global developed market peers in October, with the financials sector leading the wider decline. Major banking names such as NatWest Group (-23.89%), Barclays (-17.4%), and Standard Chartered (-17.15%) all fell on the back of disappointing third quarter results stemming from the high BoE base rate. As central bank policy rates remain elevated, interest rates have shifted from being a tailwind to a threat. Banks are paying out more in interest on their liabilities while the rates on their long-term loans (including mortgages) remain stable, effectively narrowing their net interest margins and limiting earnings.

There are also signs that high rates are increasing stress on UK construction and property sector businesses. Firms that benefitted from low interest rates or Government loans during the pandemic are now facing the delayed pain of higher rates in addition to other factors such as slower construction timeframes, dampened activity in major infrastructure, and a surge in the cost of materials.

Inflation data released during the month showed the UK CPI rate for September remained sticky at 6.7%, though October’s figure is expected to fall following the reduction in the energy price cap.

The UK’s Composite PMI slightly increased to 48.60 in October from 48.50 in September, led mostly by a lower-than-expected contraction in the manufacturing sector. While this upside surprise is welcome to those looking for better economic growth projections in the UK, the latest reading still points to a reduction in manufacturing output for the eighth consecutive month, which represents the longest period of decline since 2008/09.

US

Although drawing down by 1.8%, the US provided the best overall developed market equity performance in October.

Insurance and Aerospace & Defence names led the way, with Allstate (+15.01%), Progressive (+13.49%), RTX (+13.09%) and Lockheed Martin (+11.17%) all notable performers. Insurers have been a beneficiary of stubborn inflation, with ongoing price hikes leading to margin recoveries in names which were previously on low valuations. Aerospace & Defence manufacturers are continuing to see sales outlooks lifted by increases in global defence and military budgets amidst ongoing geopolitical tensions.

When considering style factors, growth continued to outperform value, although only slightly over the month. The dispersion between growth and value remains significant on a year-to-date basis though, with the S&P 500 Growth index returning +15.26% compared to +5.71% for its Value sibling.

US Smaller companies suffered another difficult month with the Russell 2000 index returning -5.8%. This was a continuation of a downward trend which started in July and leaves the index’s year to date performance negative at -5.6%. Risk aversion outside of large-cap names and uncertainty over the Federal Reserve’s rate policy led to the continued downturn. In particular, the index is financials heavy, containing many regional banks, and there is ongoing uncertainty over potential future regulatory impacts from the US Govt on the US regional banking sector.

US PCE inflation data for the third quarter was released in October, showing increases to both core and headline inflation on a rolling 3-month basis. This signified a slowdown in the disinflation process, and while markets are still pricing in a first rate cut around June or July 2024, the Federal Reserve may tread carefully with future monetary policy.

Europe

The -2.9% return for Developed Europe ex UK equities was in line with the global trend, with European companies particularly sensitive to earnings misses after previously misguiding the market into a more bullish sentiment. Industrials and Healthcare, the second and largest components of the FTSE AW Developed Europe ex UK index, were the worst performing sectors, with Utilities and Energy companies helping to negate some of the wider losses.

In Germany, Healthcare and related industries led detractions, with negative performance from Sartorius AG (-25.11%), Fresenius (-18.06%), and Bayer (-11.17%) of note. These three companies alone account for 6.4% of the DAX index, though performance was counterbalanced somewhat by positive returns from Technology company SAP (+3.18%) which alone constitutes 10.1% of the index.

Relative performance in France was similarly weak, with only 13 of the 40 companies in the blue chip CAC index generating positive returns over the month. Luxury retail conglomerate LVMH had a major influence here as it makes up 12.04% of the index and declined 6.5% over the month. This was a result of registering below consensus third quarter earnings primarily resulting from a slowdown in luxury sector demand and adverse currency movements on its international sales.

Headline inflation in the eurozone fell to a two-year low of 2.9% in October, down from 4.3% in September, and below the market consensus of 3.1%. The fall was largely driven by lower energy contributions, and base effects, as the 6.2% increase in energy costs recorded in October 2022 fell outside the annual comparison. The core reading, which excludes volatile food and energy prices, dropped to 4.2% in October from 4.5% in September, in-line with estimates.

Rates were left unchanged at the ECB’s latest policy meeting, with the committee unanimously deciding to keep the deposit rate at 4.00% and the refinancing rate at 4.50%. This was based on evidence of fast slowing inflation and the economy continuing to lose momentum in the second quarter of 2023. Madame Lagarde did not rule out further rate increases, however the market anticipates that they have now peaked and expect to see a cut by the end of June 2024.

Japan

Japan remains a leading performer in 2023 with the TOPIX index returning +21.94% year to date, however Japanese equity performance eased over October at -3.9%. In the early part of the month, profit-taking against a backdrop of rising bond yields and Global geopolitical tensions led to the majority of this retracement, however this was partially offset towards the latter part as flows back into Japanese stock markets picked up again.

As expected, the BoJ kept short and long-term rate targets unchanged at their latest policy meeting on the 31st, and reiterated that they will patiently continue with Quantitative and Qualitative Easing and Yield Curve Control. With underlying inflation gradually moving toward achievement of the Bank’s price stability target, their language shifted towards prioritising economic support to facilitating a favourable environment for wage growth.

Asia Pacific ex Japan and Emerging Markets

Asian and Emerging Markets equities also detracted overall in October, with the MSCI AC Asia Pacific ex Japan (-3.5%), and MSCI Emerging Markets (-3.3%) indices both providing negative returns.

On an individual country basis, the MSCI Taiwan (+16.04%) and MSCI India (+5.79%) indices remain the standout performers year to date, with Taiwan especially buoyed by better-than-expected third quarter results from TSMC, which constitutes approx. 40% of the index.

The Chinese influence on wider Asian indices was negative again over the month. China’s official manufacturing PMI came in at 49.5 in October, below expectations and unexpectedly falling back into contraction. The Non-manufacturing PMI was also below consensus, weakening to 50.6 from 51.7 in September. These figures left the composite PMI at 50.7, a 2023 low. Despite these surprise readings, the CCP still looks likely to achieve it’s 5% growth target for 2023, and mainland China indices started to outperform the rest of Asia towards the end of the month, following the Central Huijin state fund announcing it would buy CNY17B of domestic ETFs. Long term structural challenges remain, however nearer term catalysts for a change from the current deeply negative sentiment have increased.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.