Data from Refinitiv, 1 October 2023

Market insights

5 min read

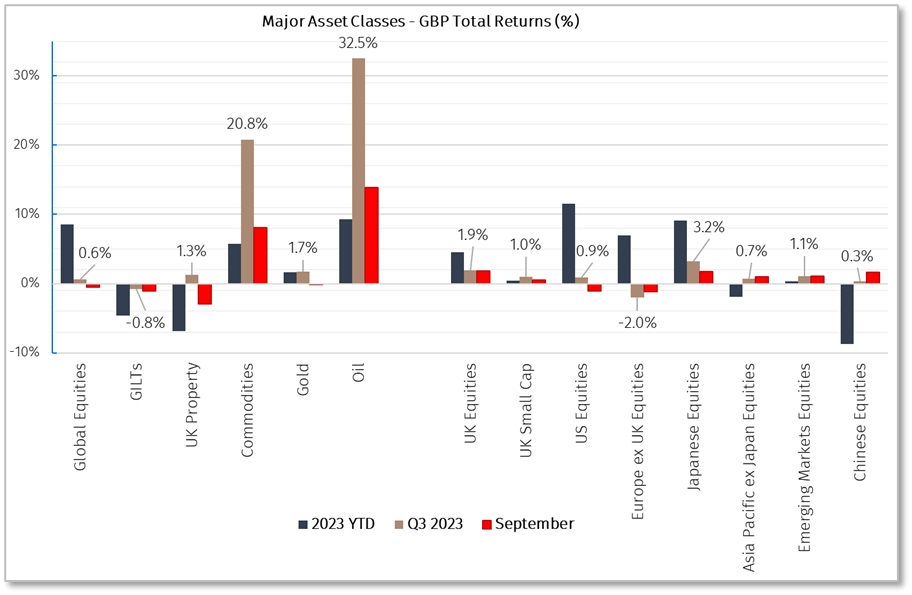

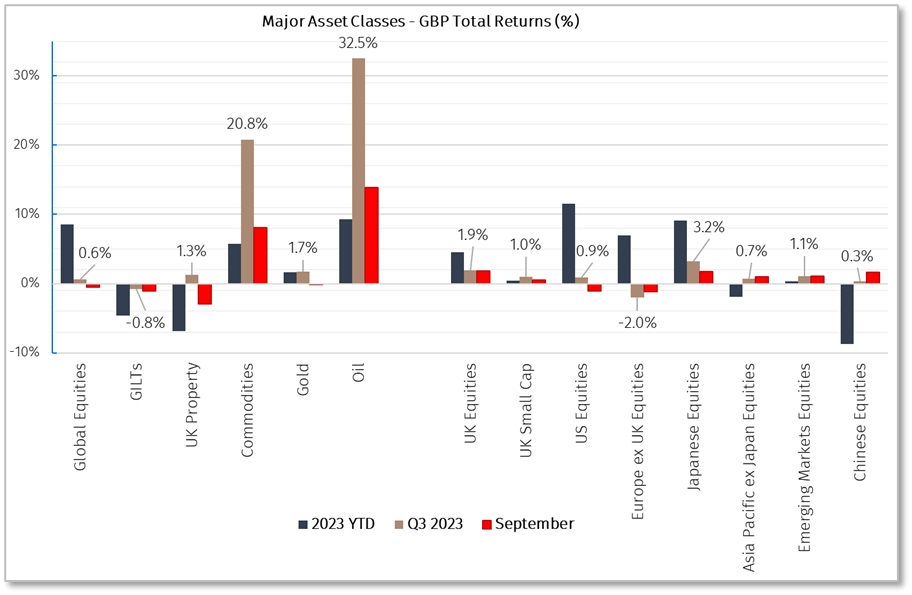

Following a strong first half of the year, global equities presented more of a mixed picture in Q3. Dollar strength vs pound sterling buoyed US equity and global equity index returns for UK investors. Global equities concluded the quarter with a modest gain of 0.6% in pound sterling (detracting 3.4% in dollar returns).

Data from Refinitiv, 1 October 2023

Towards the end of the quarter, we observed broader risk asset weakness due to a sell-off in global bond markets and a rise in longer-duration government bond yields. With equities and bonds seeing recent declines, commodities have again stood out as a notable outlier, returning 8.1% over September and 20.8% over the full quarter. This was predominantly driven by higher oil prices, which have risen 32.5% over Q3, contributed to by Saudi and Russia supply cuts. Value style equities outperformed growth, with Japanese and UK equities demonstrating resilience in the recent correction, the latter benefitting from its larger exposures to the energy sector.

The seven largest US mega-cap stocks have continued to account for most of the US market’s 11.5% year-to-date return. However, the relative outperformance gap between these companies and the rest of the index closed slightly towards the end of the quarter as rising bond yields put pressure on expensive valuations. With underweight positioning in these areas, this has been a positive for client portfolios vs benchmark exposures.

Core inflation rates continued to decline across developed markets over Q3. Economic data remained mixed, with clearer signs of deterioration in Europe, but continued resilience in the US economy. Progress on inflation allowed the Federal Reserve and Bank of England to pause rate hikes in September, however the accompanying communications had a hawkish tone and reiterated rates will be ‘higher for longer’. Government bond yields increased as a response, with fiscal sustainability concerns and expectations for further bond issuance exacerbating the issue for US treasuries.

Our top-down views are unchanged, and over the shorter-term we acknowledge there may be complacency within risk assets for anything other than a soft-landing. With this in mind, we believe it is sensible to balance offence with defence. On a longer timeframe, while consensus is for inflation to continue to cool over the near-term, we still see a benefit of holding assets with inflation protection from a diversification perspective and believe there is a higher probability of inflation volatility on a longer-term view than is currently priced in. Within fixed income, we continue to see value in gilts and have recently become more positive on gradually increasing our duration risk, locking in attractive yields for longer. We currently see particular value in US treasury inflation-protected securities which are offering above 2.5% real yields (yields minus inflation). We remain neutral in equities, with attractive valuations in areas of the market, including UK equities and smaller companies, contrasting with a more cautious view on economic growth.

Average discounts across most investment trust sectors have seen little change through the quarter, however real assets investment companies did see some further discount widening during September. This was primarily in response to the rise in long duration government bond yields, which tend to have a negative impact on net asset values and on companies using leverage. Although the pricing in of interest rate cuts has recently shifted from late 2023 to the second half of 2024, we believe the ‘watch and wait’ approach recently communicated by central banks is sensible and a continued trend of cooling core inflation should reduce pressure to raise rates further from here. In turn, this should diminish this headwind on real assets investment trusts, which has been persistent throughout the year. It has also been pleasing to see that corporate activity in the investment trust sector has continued, most recently with a takeover offer, a proposed merger, and several other strategic reviews. We expect activity to continue over coming months as boards remain under pressure to extract value for shareholders and act on persistent share price discounts.

The UK equity market saw a positive return of 1.9% over the quarter, which was primarily driven by energy sector returns (contributing 1.5%). While merger and acquisition activity overall has remained relatively muted, there were several deals over the period among the small caps which contributed to performance for the smaller companies index.

Headline and core inflation slowed faster than expected to 6.7% and 6.2% respectively, which allowed the Bank of England to pause its hiking cycle. Economic growth slowed further, as the Composite PMI dropped to 46.8, marking the fastest reduction in output since Q1 2021. On a less negative note, the UK’s post-pandemic recovery was revised higher: the economy was 1.7% larger than previously estimated as of Q2 2023.

European equities detracted by 2% over the quarter and were the worst regional performer. The largest sector detractions occurred in the consumer discretionary and technology sectors, partly due to concerns regarding higher energy prices and higher interest rates on consumer disposable income. Financial services and energy were both brighter spots in the index, contributing 1.0% and 0.6% respectively.

Similar to the UK, inflation surprised to the downside with both core and services inflation falling faster than expected in September. The ECB raised interest rates in September by 0.25% to 4% which was accompanied by dovish comments that this was likely to be the last hike in this hiking cycle. Economic data remains weak and growth headwinds are likely to persist in tighter financial conditions.

Dollar strength contributed to US equity index performance of 0.9% in pound sterling returns over the quarter. However, the index was down 4.8% in base currency. The market saw broad sector contributions at the beginning of the quarter, with technology and AI related names the notable outperformers. However, this reversed in September as many of the expensive mega-cap technology companies, including NVIDIA (-8.5%), Apple (-5.4%) and Amazon (-4.4%), corrected. Following the fast-paced valuation expansion and against conditions of rising treasury yields, a correction has been unsurprising. The energy sector was the leading contributor (contributing 0.7% to the index) over the quarter, with Exxon Mobil Corp (+9.8%) and Chevron Corp (8.7%) both benefitting from a higher oil price.

The TOPIX continued its strong performance in September and ended the quarter as the standout performer, delivering 3.2%. Financial services and consumer discretionary sectors were leading contributors (adding 1.9% and 1.1% respectively). Core inflation slowed in September for the third straight month, mainly on falling fuel costs suggesting that cost-push pressures are starting to peak. The Yen has continued to weaken, and the Japanese 10-year government bond yield has moved up to 0.78% based on expectations that the BOJ may be forced to bring yield curve control policy to an end.

Over Q3, Asia ex Japan and global emerging markets indices were up 0.7% and 1.1% respectively in sterling terms. Taiwan, Hong Kong, and South Korea were the weakest areas, while India continued its strong positive momentum. Stocks in mainland China saw significant declines in August, with the country's property sector notably weak. We did start to see an improvement in sentiment for Chinese equities in September, as the government stepped up stimulus. So far, the Chinese government has lowered key interest rates, freed up more long-term cash into the banking system, added support for housing sales and household consumption, and accelerated the issuance of special local government bonds since August. With rates remaining low, there is a possibility excess liquidity ends up in the equity market, particularly with equity valuations at current depressed levels.

Growth data has been more resilient than expected across economies but continues to paint a mixed picture. Data in China improved in August with both retail sales and industrial production growth increasing. In ASEAN markets, PMIs in export-oriented economies such as Malaysia, Vietnam, and Singapore remained below 50 but Indonesia’s manufacturing PMI remained strong.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.