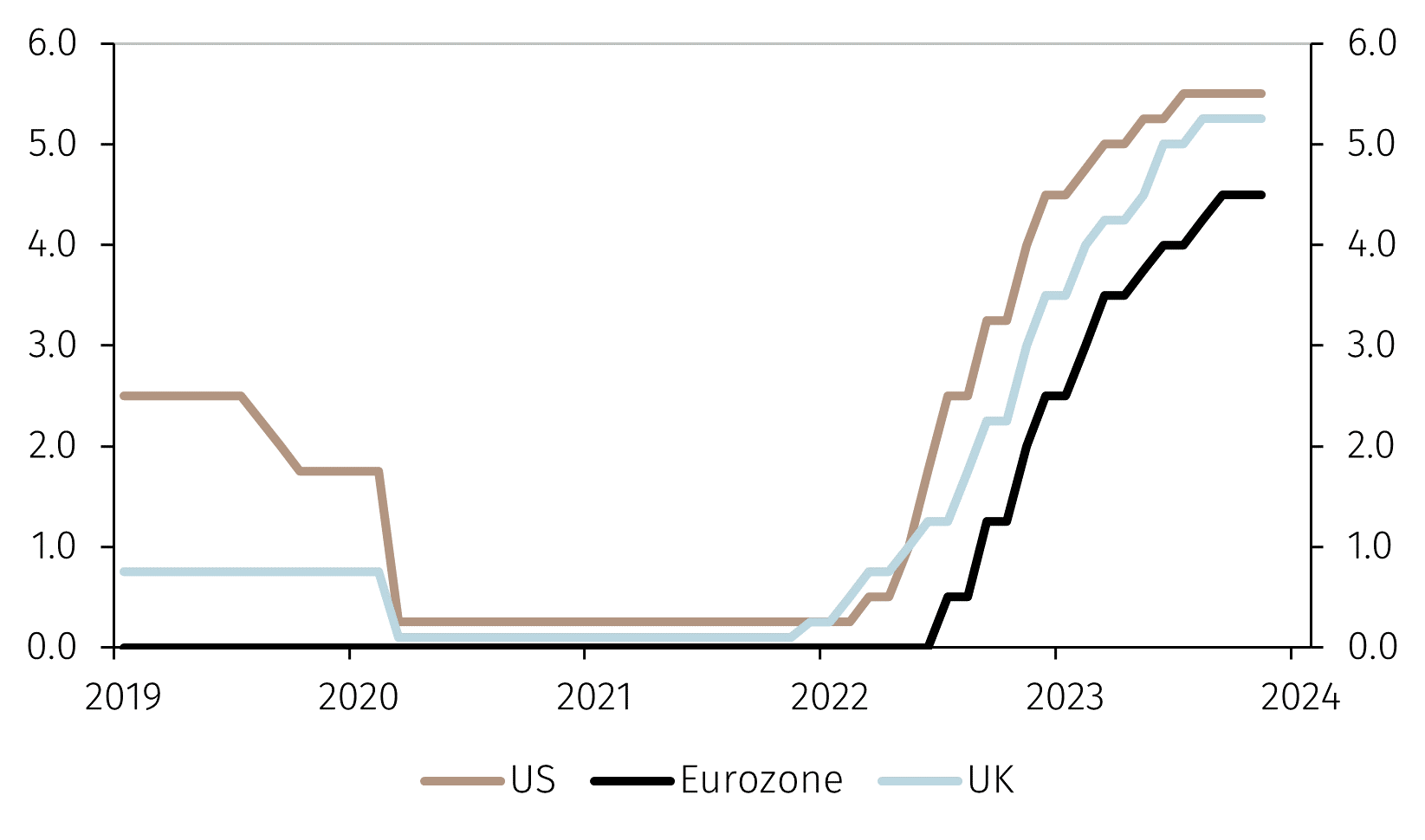

Over the last few years, the Bank of England (BoE) has been viewed as more tolerant of inflation in comparison to other developed market central banks. Despite being one of the first advanced economy central banks to hike rates in the most recent cycle, the gradualist approach of the Monetary Policy Committee (MPC) in slowly raising rates, differed from the US Federal Reserve and the European Central Bank that both frontloaded their monetary policy tightening (see Chart 1).

Have interest rates peaked in the UK?

Market insights

7 min read

Have interest rates peaked in the UK?

Over the last few years, the Bank of England (BoE) has been viewed as more tolerant of inflation in comparison to other developed market central banks.

Chart 1. Central bank policy rates (%)

Source: LSEG Data & Analytics and EFGAM. Data as of 13 November 2023.

Former members of the MPC argued at a recent BoE Watchers conference that the Bank’s dovish approach was due to the nature of the shocks that drove the surge in UK inflation. Commentators believed that the UK economy had been hit by a succession of tail risk events. Some of these were global events, such as the Covid-19 pandemic and Russia’s invasion of Ukraine. Others were idiosyncratic to the UK, such as Brexit. The MPC believed that, given the long lags with which monetary policy affects prices, over-tightening in response to these supply shocks would have risked magnifying the impact on activity.

On 2 November, the BoE voted to keep interest rates unchanged at 5.25%. In addition, the MPC highlighted the need to keep monetary policy sufficiently restrictive for long enough to bring inflation down to the 2% target. Markets, which expected this decision, interpreted the Bank’s comments as hawkish, after references to any imminent potential rate cuts were removed from the Monetary Policy Report. Nonetheless, markets have reached a consensus that interest rates in the UK have peaked and, in the absence of any large shocks to the economy, should stay at current levels for the rest of 2023 and part of 2024.

The MPC has previously referenced wage growth, the unemployment rate and GDP growth as the key variables the committee is following to gauge the evolution of prices and the impact of monetary policy on the economy. With interest rates having been increased by more than 500bps since December 2021, these three variables have started to show signs of deterioration:

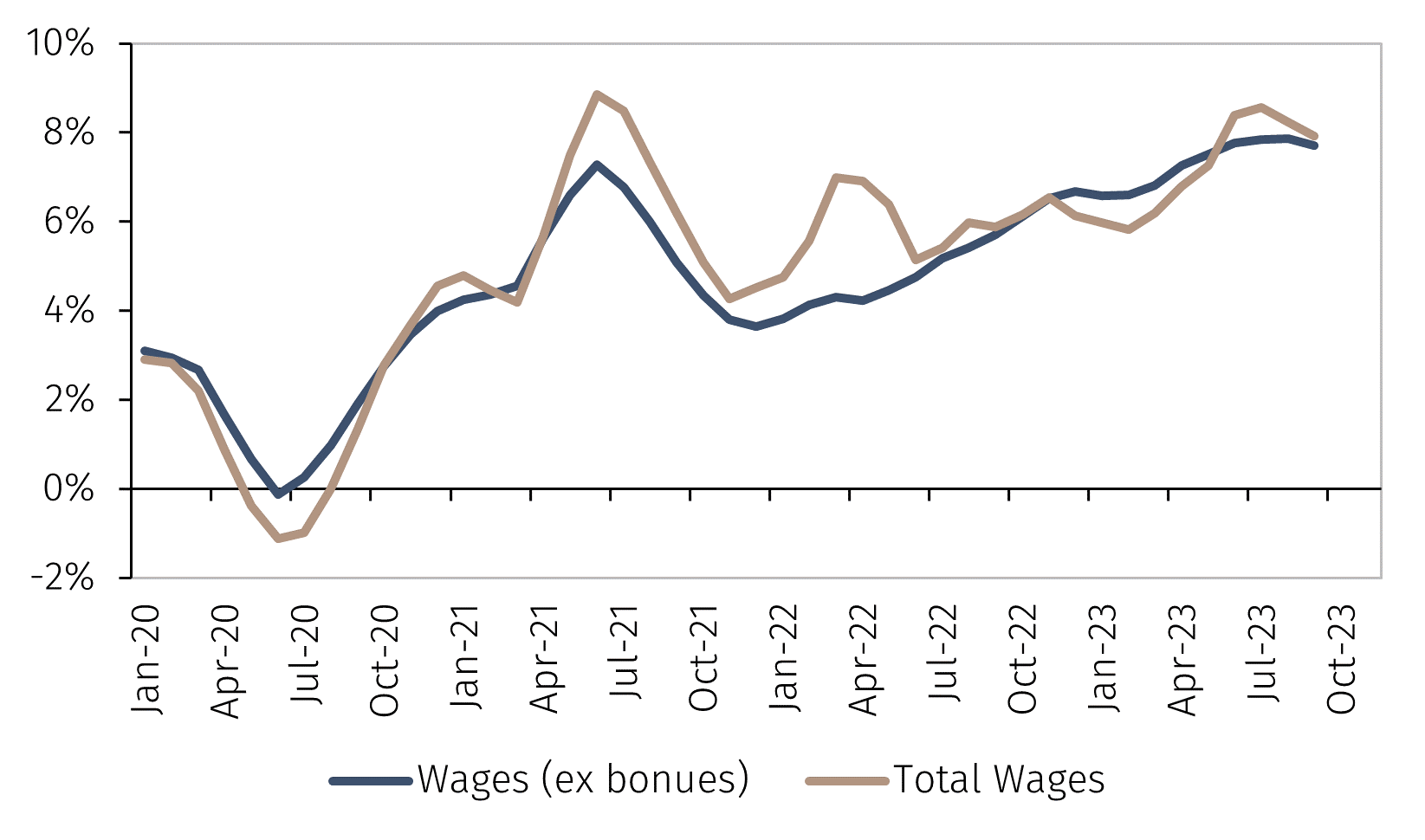

- Wage growth, measured by the three-month average of private weekly earnings, appears to have peaked at 8.5% year-on-year (YoY) in July and has since been in a declining trend, currently standing at 7.9% YoY (see Chart 2.1). The BoE maintains that the increase in wages has not been matched by a commensurate rise in productivity and risks fuelling inflation.1 Other measures of wage growth tracked by the Bank, such as the indicator from the HMRC tax system and the Decision Maker Panel survey of UK businesses, point to less rampant wage growth. The Bank has therefore maintained its expectations for average earnings growth to decelerate to around 6% by the end of 2023. This remains above the most recent annual productivity growth of 0.1% in Q2-2024, but still reflects a deceleration in comparison to recent months.2

Chart 2.1. Average weekly earnings (%YoY)

Source: LSEG Data & Analytics and EFGAM. Data as of 13 November 2023.

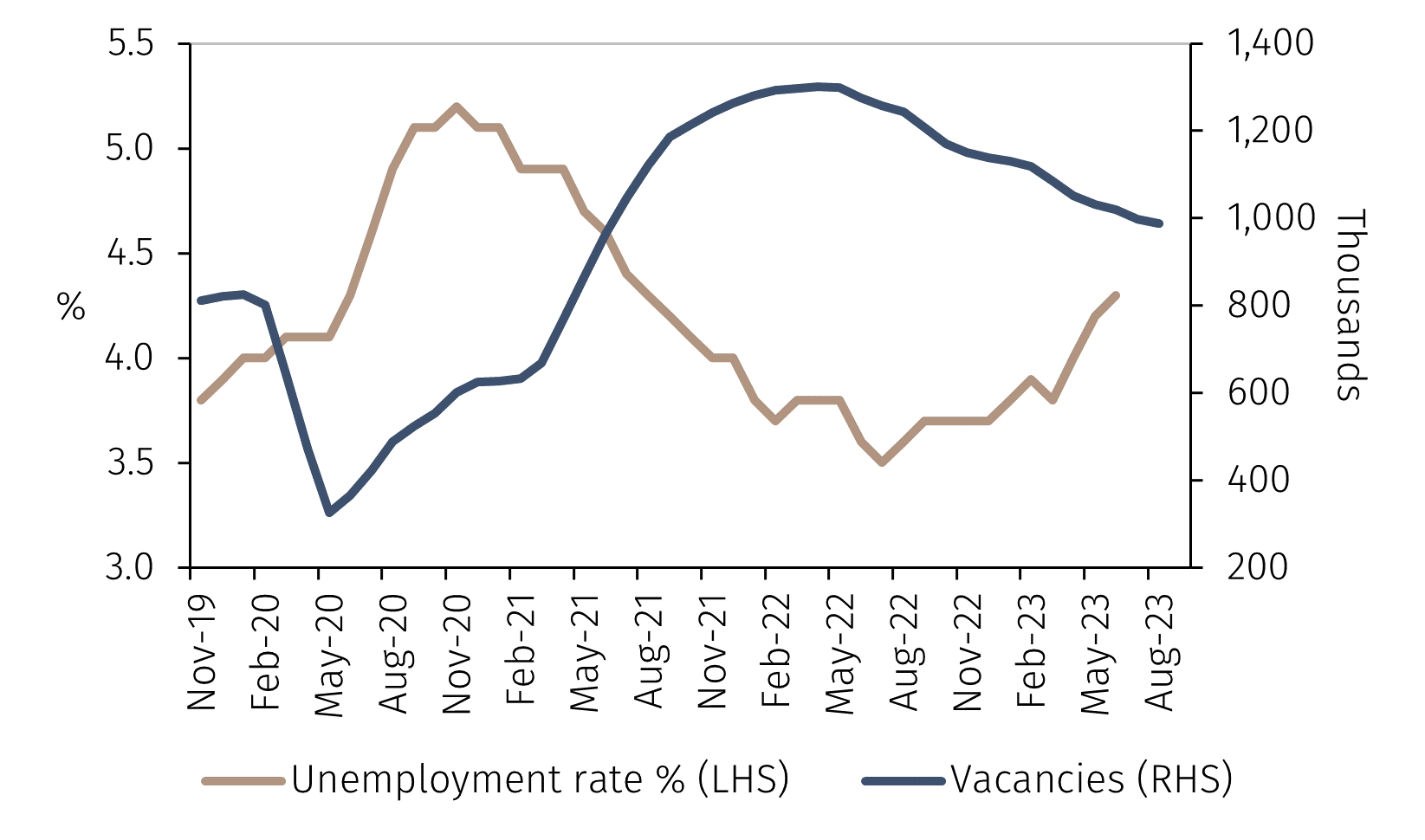

Chart 2.2. Unemployment and vacancies

Source: LSEG Data & Analytics and EFGAM. Data as of 13 November 2023.

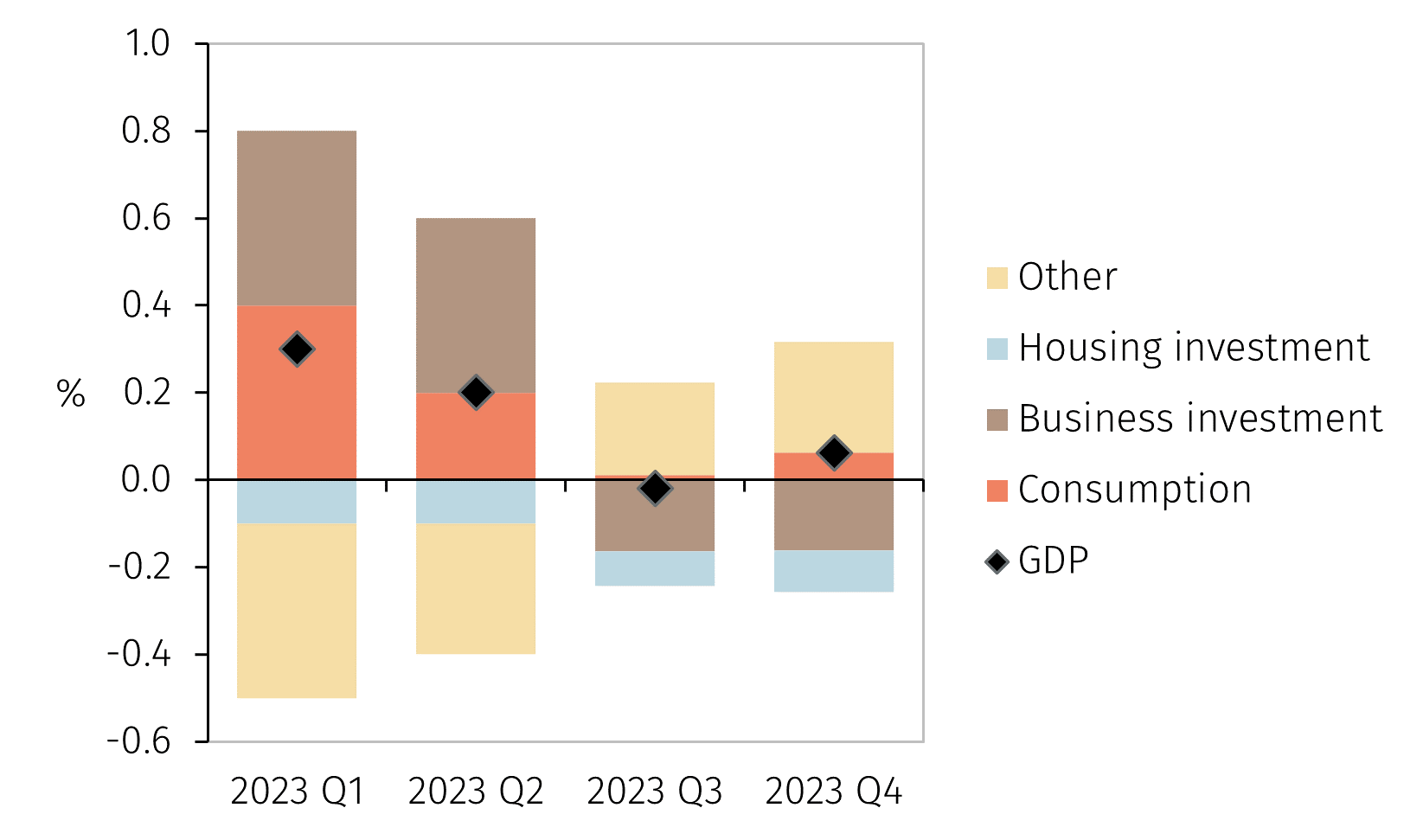

Chart 2.3. Contributions to quarterly GDP growth

Source: Bank of England and EFGAM. Data as of 13 November 2023.

- Supporting this expectation is the fact that labour market conditions have loosened since the start of the year. The unemployment rate increased to 4.3% in Q3-2023 and is expected to rise to 5% in 2024 and 2025 and to 5.1% in 2026 according to BoE forecasts. This would match the peak in the unemployment rate witnessed during the Covid-19 pandemic in late 2020. According to MPC members, the decline in the UK’s economic openness since Brexit and the end of the pandemic has made demand for labour harder to fill, improving workers’ bargaining power.3 Furthermore, the Office for National Statistics has seen a decline in the number of respondents to the Labour Force Survey since the pandemic and plans to introduce a new methodology in the spring of 2024. Declining survey participation has raised questions over the accuracy of recent data on employment and vacancies, which is important as most of the easing in labour market conditions observed recently has been attributed to the decline in the number of vacancies (see Chart 2.2).

- Finally, economic growth has been weaker than previously anticipated, but surprisingly resilient given positive contributions from consumption. The BoE estimates that more than half of the impact of higher interest rates on GDP growth is yet to come through. The impact of higher financing costs is already being observed in housing investment, which has declined since early 2022 but will take longer to be reflected in consumption data (see Chart 2.3). The BoE forecasts quarterly UK GDP growth of 0.6% in Q4-2023, but risks are titled to the downside.

- To conclude, given the ongoing normalisation of labour market conditions and the weakness of GDP growth, the BoE’s decision to keep rates on hold in November was unsurprising. At this point, the committee seems to prefer avoiding overtightening monetary conditions and magnifying the expected decline in activity. In the absence of shocks, we would expect the BoE to remain on hold for the remainder of 2023 and the first half of 2024. This is in line with market expectations, which currently assign a probability of 40% to a rate cut in June 2024. The MPC adopted a more gradual pace of policy tightening in 2022 and it could be argued that this led to more persistent inflationary pressures. It remains to be seen whether they will follow a similar strategy when it starts cutting rates.

1 It is worth noting that the risk of a wage-price spiral appears overstated; see EFG Infocus, ‘How high is the risk of a wage-price spiral?’, September 2023: https://go.pardot.com/e/931253/-Infocus-wage-price-spiral-pdf/3qpfx/290669697/h/4GCUAxdyAmiaLZQGF-2ftOfZ6dDm74onQUw26hUimNE

2 Productivity growth measured as output per hour worked in Q2-2023. https://go.pardot.com/e/931253/oductivity-rebounds-in-q2-2023/3qpg1/290669697/h/4GCUAxdyAmiaLZQGF-2ftOfZ6dDm74onQUw26hUimNE

3 https://go.pardot.com/e/931253/ference-labour-market-dynamics/3qpg4/290669697/h/4GCUAxdyAmiaLZQGF-2ftOfZ6dDm74onQUw26hUimNE

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.

This document has been produced by the EFG Harris Allday research team utilising data from documents produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.