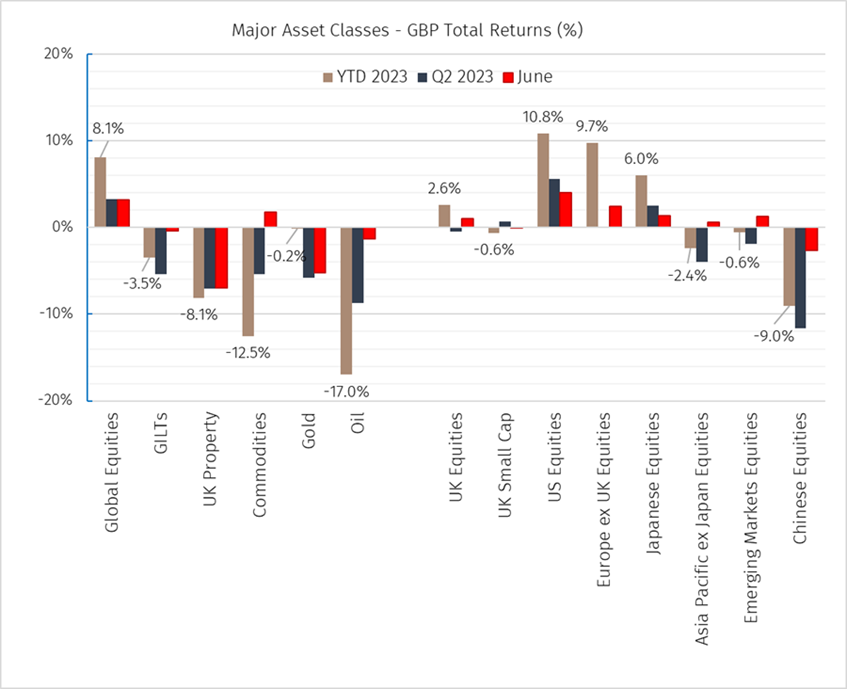

We began the year with a multitude of risks to economies and risk assets. The subsequent resilience of financial markets has caught many investors that were positioned for a bearish scenario off guard. While global equity markets have recorded a 4.5% return up to the end of May, it is important to note the narrow market leadership, with over 70% of this return attributed to the technology sector. The consensus view that we are close to approaching peak rates and recent investor enthusiasm surrounding Artificial Intelligence (AI) have both buoyed technology company returns. Large-cap, monopolistic technology companies have performed particularly well, winning through pricing power and the squeeze on smaller suppliers. It is not unusual for the largest-cap stocks to have significant influence on the performance of cap-weighted indexes such as the MSCI World or S&P 500. However, when a majority of constituents underperform the overall index, concentration risks become more pronounced. Across broader sectors, signs of economic stagnation have been more apparent with cyclical areas such as energy and banks among the weakest areas. As we approach the end of the first half of the year, performance contributions across sectors within global equities are remarkably close to a perfect mirror image of 2022.

Looking forward, the key risks to equity markets continue to be uncertainty around central bank policy, weaker corporate earnings and more recently, signs of a return of exuberance and extended valuations in certain areas of the market.

We continue to believe active tactical positioning and a commitment to being selective across regions and industries can reduce risks of overconcentration and provide strong performance over the longer term. Notable brighter spots of the market currently include Japanese and emerging market equities, which hold attributes of stronger growth, lower inflation, and easier policy. In addition, valuations in the UK remain attractive relative to other major markets. We continue to favour broad diversification at a sector level with exposures to defensives, higher quality cyclicals and technology companies where valuations have not become excessive. More specifically in the AI space, there are undoubtedly large amounts of optimism within the valuations of the leading beneficiaries at present, however investors that can analyse and identify the less obvious structural winners and losers and avoid chasing shorter-term periods of performance will be better placed. AI is also not just a US story and valuations outside of the US stock market remain attractive on a relative basis.

Closer to home, the UK has continued to hold the unwanted position of having the highest inflation rate among major global economies. The surging cost of food, a shortage of workers to fill jobs and the country’s reliance on natural gas to generate power and domestic heating have all contributed to inflation pressure. Headline inflation has gradually cooled throughout the year, albeit remaining firm in May at 8.7%. More concerning for investors, core CPI, which excludes volatile items such as energy and food, has been steadily rising over recent months and is seemingly pointing to sticky, stubborn inflation. Recent data has also revealed wages have risen at their fastest pace on record outside the Covid-19 period, adding to concerns about stubbornly high inflation and further interest rate rises. UK government bonds have responded. During June 2-year and 10-year gilt yields hit 5.08% and 4.49% respectively, exceeding levels reached during the ‘mini-budget’ debacle of September last year and hitting the highest levels since 2008.

The spike in bond yields since the start of last year has enhanced the return potential in various fixed income sectors. Nonetheless, we believe that a meaningful portfolio shift towards longer-term bonds may still be premature. The inflation picture remains uncertain in the medium term and investors should be cognisant that the nominal yields that are locked in may be below the rate of inflation, resulting in negative real returns, for some time. Despite this, we believe investment grade shorter-dated fixed income has a role to play in portfolio diversification and as an option for when opportunities in riskier assets arise. Selective active management by skilled managers within the high-yield bond space may also be well placed barring a scenario of a deeper recession.

Interest rate rises have also triggered a repricing of assets in the investment trust space and discounts have remained historically wide vs long term averages in 2023. We are currently seeing pockets of value across several sectors. Property and infrastructure trusts are now providing average yields between 6-7%, with inflation-linkage and scope for income growth which traditional bonds do not offer. Discounts for these sectors currently stand at an average of 18% to net asset value, which follows many trusts within alternatives trading at a premium for most of their prior history. While higher risk-free rates have justified some re-pricing, we believe there are attractive opportunities here. In recent months we have also seen a number of investment trust Boards implementing strategic reviews or proposing other corporate activity. We see this as a positive tailwind for the investment trust sector as a whole.

In the current environment we continue to favour a degree of balance and broad country and sector level diversification across our strategy risk levels, taking an offensive stance in some areas and defensive in others. From a top-down perspective, we believe it is important to regularly review which risks are mispriced by the market and how we can position ourselves intelligently to capitalise or hedge against them. We expect the global economy to continue to slow in the second half of 2023 and remain cautious of the lag effects of recent monetary policy actions and tighter credit conditions. We are also conscious of the complexity of this unconventional market cycle, with contradictory signals on the nearer-term direction persisting. On a longer timeframe, we believe it is important to not rule out another wave of rising inflation, despite shorter-term downward trends. From an investment selection perspective, we are prepared to be dynamic and patient in our approach in order to unlock value over the long term.

The value of an investment and the income from it can fall as well as rise, and investors may not receive back the amount they invest. Past performance is not a guide to the future.