Several factors contributed to this, including Covid-related supply chain bottlenecks, an exceptionally accommodative policy mix, and surging commodity prices. In this Macro Flash Note, Senior Economist GianLuigi Mandruzzato looks at these factors and infers where inflation is headed in the coming quarters.

The rise in inflation from mid-2021 had three main causes:

- Global supply chain disruptions due to the Covid-19 pandemic.

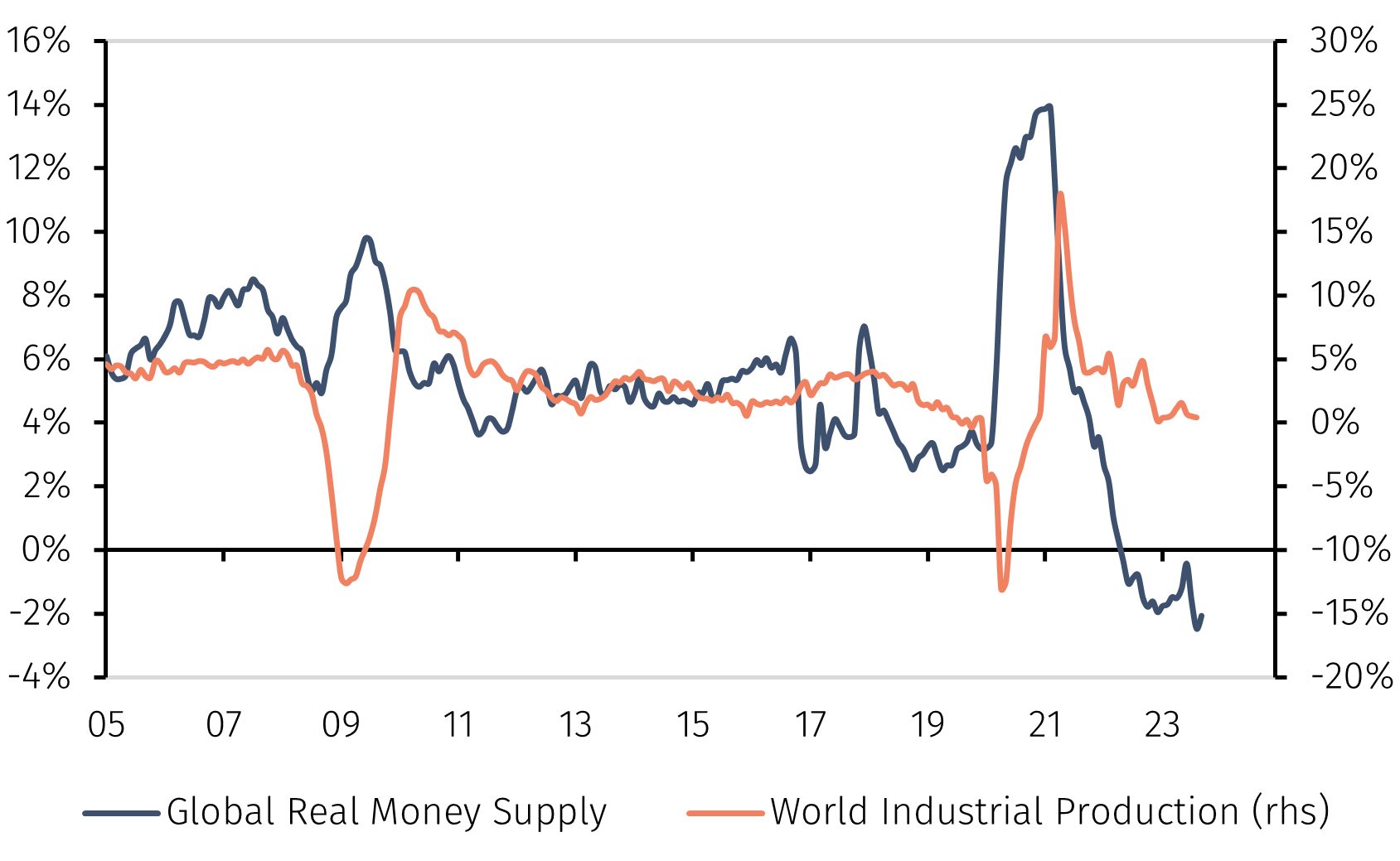

- Exceptional monetary and fiscal policies to support the economy during the pandemic.

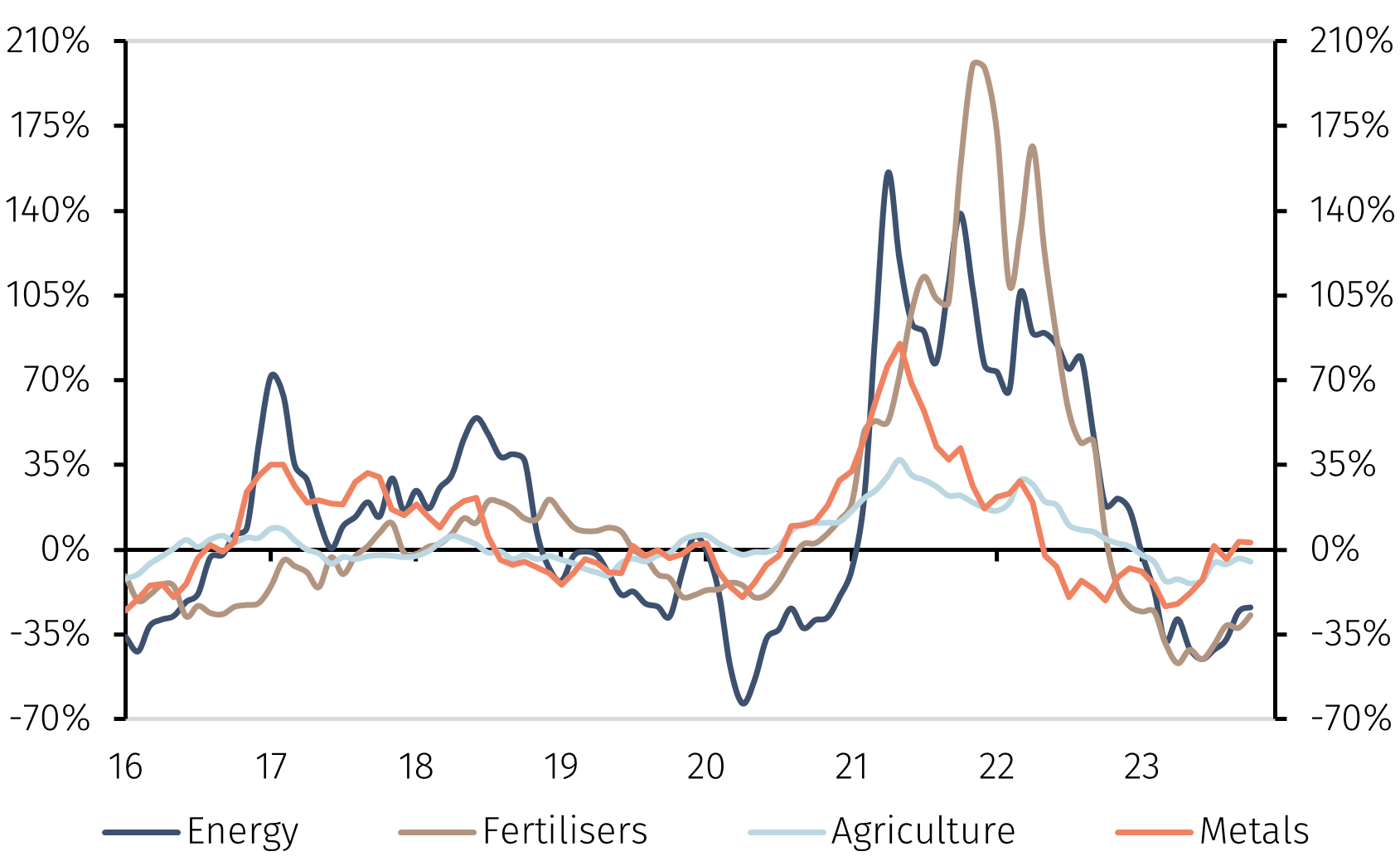

- The shock to commodity prices following Russia's invasion of Ukraine.

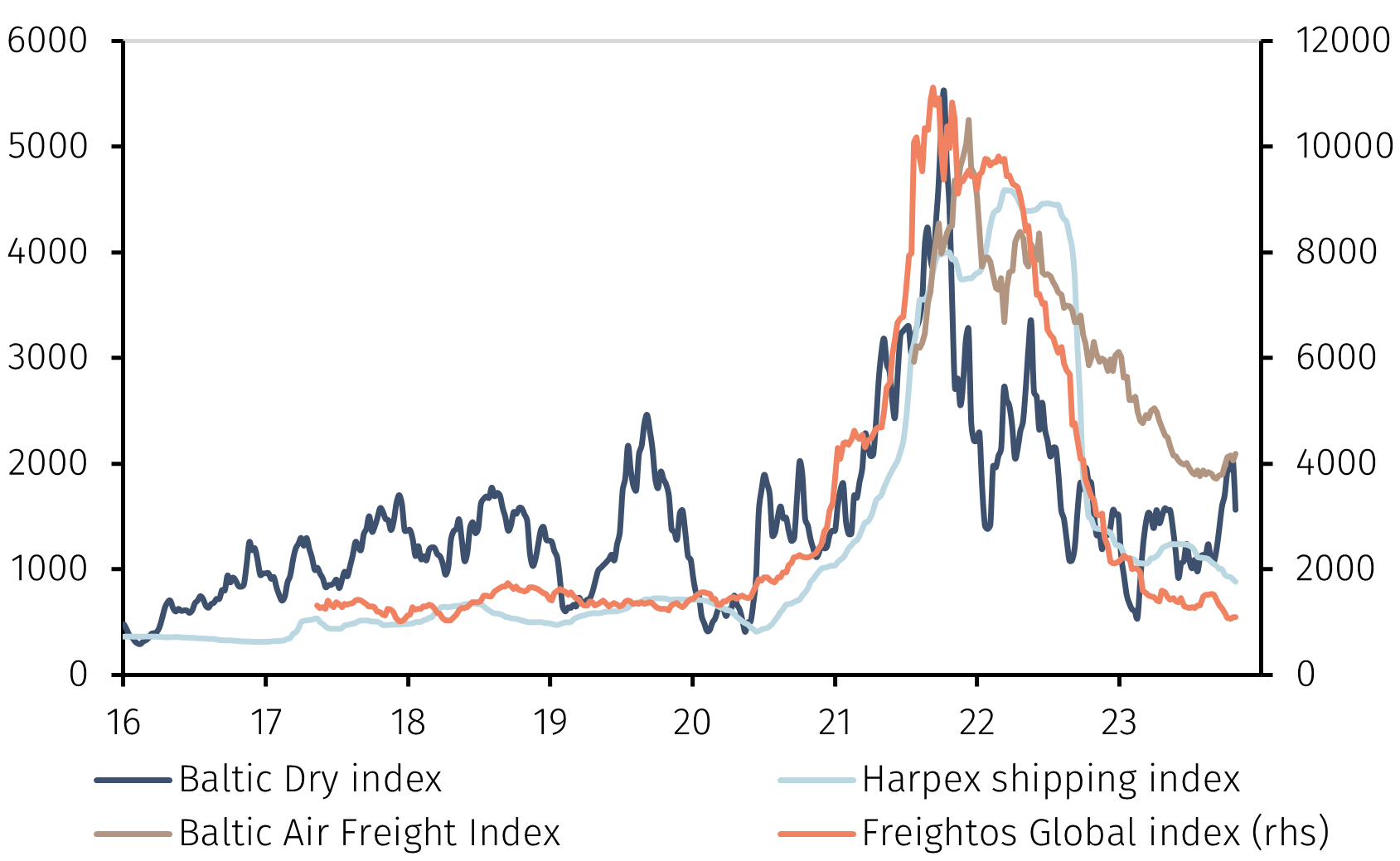

Global supply chains were disrupted by the Covid-19 pandemic, leading to a nine-fold increase in global freight rates and increasing imported goods prices (see Chart 1). Having peaked between late 2021 and mid-2022, freight rates fell quickly following the normalisation of labour markets after a pivot away from anti-Covid policies and the expansion of shipping fleets. On some routes, shipping costs have fallen below levels witnessed in 2019. This will exert downward pressure on durable goods prices, whose inflation rate is converging towards the barely positive level that prevailed before the onset of the pandemic.