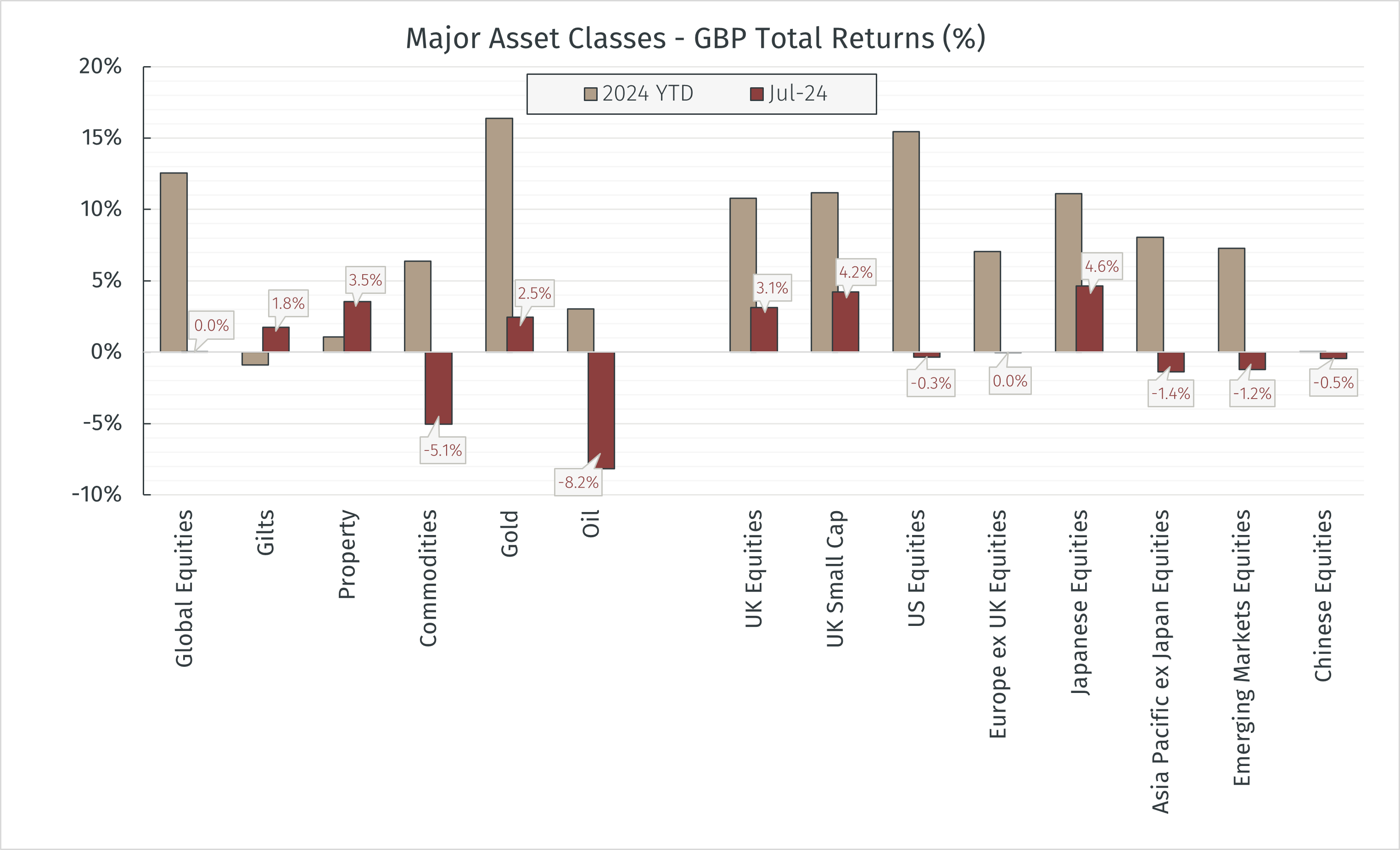

July perfectly encapsulated just how much influence the US market, and in particular it’s few leading mega-cap tech companies currently have on global equity returns. Making up c.65% of the MSCI All Country World Index, the US market’s flat GBP return over the month was reflected in the global benchmark. Although equity performance broadened out in the US with the small-cap Russell 2000 Index returning over 8% in GBP terms, and the equally weighted version of the S&P 500 Index significantly outperforming the traditional market-weighted index (+2.8% vs -0.3% in GBP), the negative performance of the tech-heavy Nasdaq 100 Index (-3.2% in GBP) emphasised the comparative dominance that the technology sector holds.

The broadening out in US equities was encouraging, and supportive of the case for active management. It could be seen as a reminder to investors that a range of attractively priced opportunities remain outside of the concentrated list of names which have driven the markets over recent times. The rotation out of growth and momentum plays primarily came in the wake of a cool June inflation print released on 11 July which added confidence to the belief that the Federal Reserve may soon begin an interest rate cutting cycle. While the Federal Open Market Committee decided to hold rates steady at their 31 July meeting, Chair Powell did mention that a rate cut could be on the table as early as September, while continuing to stress their data-dependent approach.

European equities also lagged overall in July. In what felt like a stalling month, disappointing regional economic growth figures and the hung parliament outcome to the French election both contributed to the region’s underperformance. By comparison, the unsurprising result of the UK election spurred further flows into UK equities, with the FTSE 250 index seeing its strongest month year-to-date (+6.7%). Although the change of government at Whitehall was largely priced-in, the confirmation of an outright Labour majority combined with good economic data to provide another bump to local indices.

Japanese equities were relatively flat in local currency terms, but a rally in the yen resulted in indices rising in GBP terms. After an extended period of weakness versus other major currencies, markets started pricing in a narrowing of interest rate differentials between Japan and western economies. On the final day of the month, the Bank of Japan delivered an interest rate hike, raising its base rate to 0.25%, and added that it plans to reduce the amount of Japanese Government Bonds it will buy over the coming years.

Chinese indices fell to six-month lows as economic data for Q2 and June both disappointed. The People’s Bank of China responded by easing monetary policy and unexpectedly cutting interest rates across a range of products aimed at boosting growth. So far, the response from businesses has been muted, and the market response was to send equities, Chinese Government Bond yields, and the yuan lower.

Elsewhere in the Asia Pacific and Emerging Markets regions there were some areas of strength, with equity markets in India, Singapore, and Brazil all gaining, however the weakness in China, Taiwan and South Korea dragged down regional indices.

As was seen with the performance of small cap equities, other interest rate sensitive asset classes such as property and bonds performed well in July. This included sovereign bonds on both sides of the Atlantic, with US Treasuries and multiple European government bonds gaining over 2%. UK Gilt returns, while good, were slightly lower at 1.8% as sticky services inflation combined with relatively strong UK GDP growth hinted that the Bank of England may cut interest rates more gradually than the Federal Reserve and the European Central Bank.

Oil prices reversed previous gains seen in June as market participants factored weaker demand from key consumer countries such as China against ongoing supply constraints. These same China worries also pushed down other industrial commodities such as copper, steel, and iron ore, though precious metals including gold gained on continuing Middle East tensions and US economic concerns.

At the time of writing, the Bank of England has just announced their first interest rate cut in four years, reducing the base rate by 0.25% to 5%, and a weaker than expected US employment report has led to uneasy rumblings around the health of the US economy. Further key data and the potential level of central bank policy amendments remain to be seen, but the initial reaction is supportive of our view that remaining regionally diversified reduces overall risk and opens up scope for capitalising on attractively valued opportunities in areas such with stronger economic momentum.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.