N.B. All performance details are in GBP terms unless otherwise stated.

LLSEG Data & Analytics, 2 April 2024

Market insights

4 min read

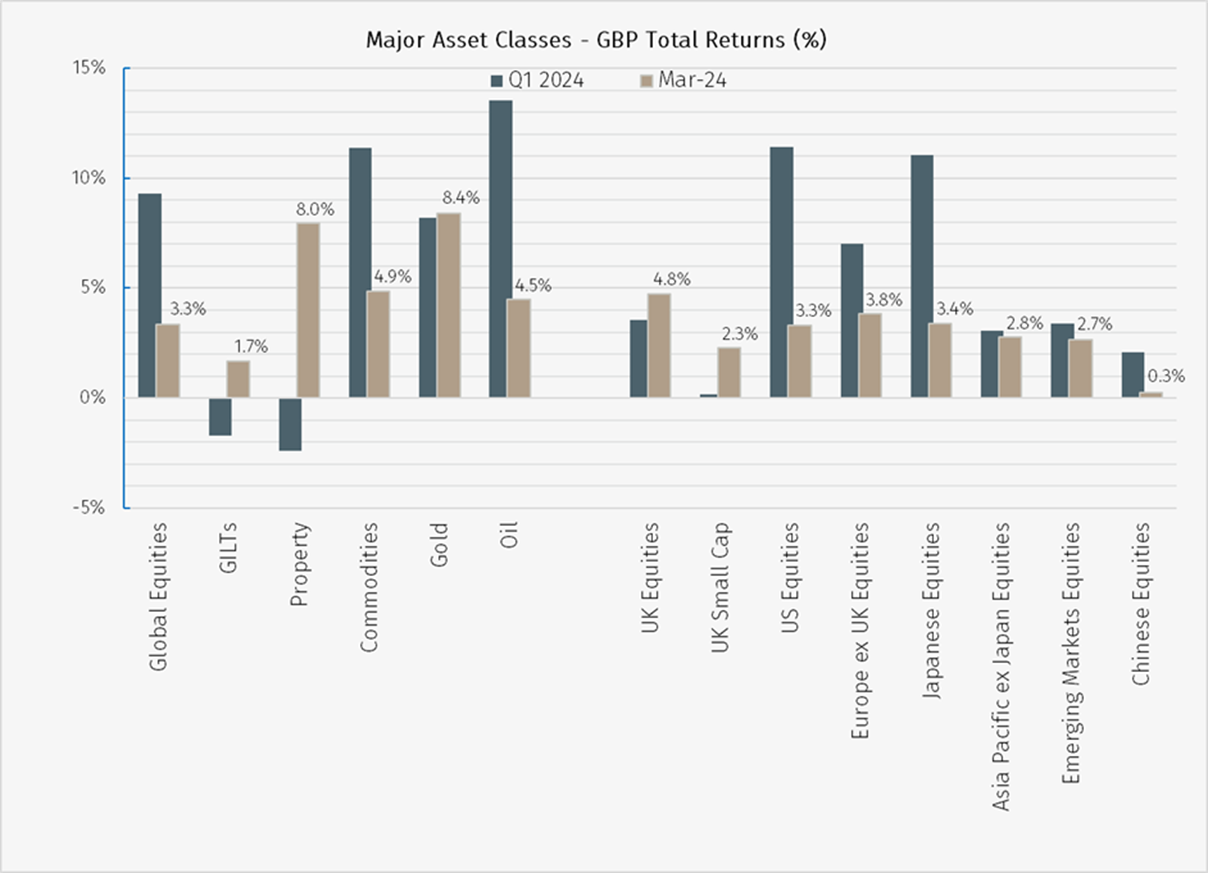

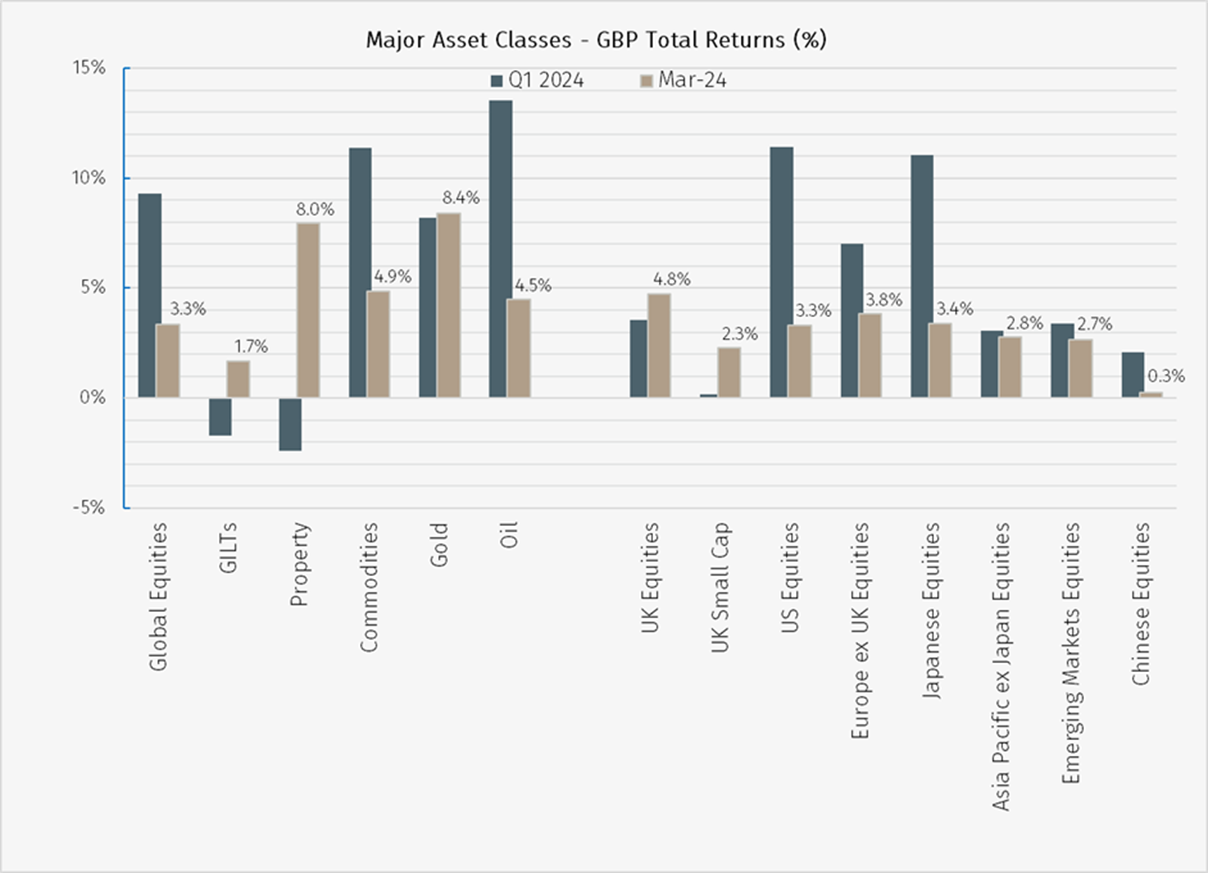

A combination of continued resilience in economic data and dovish central bank policy messaging spurred positive performance across all major asset classes during March, as the prospect of interest rate cuts neared.

N.B. All performance details are in GBP terms unless otherwise stated.

LLSEG Data & Analytics, 2 April 2024

A noticeable theme in equity markets last month was some performance catch up from companies on the eastern side of the Atlantic, with data compiled by both Morgan Stanley and Bank of America showing fund managers and global hedge funds have been increasing their exposure to European stocks while reducing weightings in US equities, citing valuation concerns. European equities currently trade at 14 times forward earnings estimates, compared to 21 times for the S&P 500.

The greatest equity market gains over the month came from the UK, where PMI data held within expansionary territory, year-on-year inflation eased to 3.4%, and January GDP data expanded 0.2%. There were also signs of stabilisation in the retail market as consumers were more optimistic about their personal finances. The prevalence of Retail, Financial, Oil & Gas, and Materials names within the FTSE All-Share also helped tip the scales in the UK’s favour, as those sectors were among the month’s strongest performers.

Despite the preference for Europe, US markets by no means fell flat in March, returning 3.3%. With the soft landing and disinflation narrative still firmly in place, the S&P 500 logged its fifth straight monthly increase, setting multiple new record highs along the way. The US remains the best performing equity market year-to-date.

Encouragingly, the month was also marked by an improvement in breadth, with the equal-weight S&P beating its market-weighted sibling, and small-caps also rising for the fourth month out of the past five. Energy, Utilities, Materials and Financials led sector returns in the US, with Consumer Discretionary, Real Estate and Technology, although slightly positive, being the weakest performers overall.

Japanese equities continued their strong performance in the face of a normalisation of monetary policy. News of employment unions securing pay rises of over 5% proved to be the final indicator that the Bank of Japan was waiting for to solidify confidence that the conditions for inflation to reach its 2% target sustainably are in place. The bank subsequently ended their negative interest rate policy and formally exited its yield curve control framework, though monetary policy in Japan remains relatively accommodative and is likely to continue to do so into next year.

Elsewhere in Asia, equities posted another month of gains, although somewhat modest in comparison to previous months. Outside of Taiwan’s Taiex index, which rose over 5% on the back of its exposure to semiconductors and AI-related technology companies, Asian & Emerging Market indices were significant underperformers vs. their developed market peers. Notable in this regard is China, whose Shanghai Shenzhen CSI 300 Index remained tepid over March, a stark contrast to its almost 10% gain in February. This flatness came as China's latest year-on-year industrial production, retail sales and fixed asset investment figures all rose and largely beat expectations, with the strong data likely meaning the long-sought after consumer stimulus program may be delayed further, or may not arrive at all.

Sovereign bonds in both the US and UK were mostly firmer over the month, with yields pulling back across most maturities. The UK Spring Budget seemed to have had little impact on gilt yields overall as the announced policies don’t have much impact on the overall medium-term financing position of the government. A small increase in gilt issuances is expected in the 2024/25 financial year, but this was already expected.

The most notable interest rate sensitive beneficiary from the dovish central bank policy messaging last month was the property sector. Although returns remain negative year-to-date due to weakness in the preceding months, the sector recovered by 8% over March.

Oil and broad commodities continued their strong start to the year, buoyed by favourable supply and demand dynamics among ongoing European construction projects and the volatile geopolitical landscape.

The stand-out performer for primary asset classes in March was gold, which saw its best month since July 2020 (+8.4%), setting new record highs. US dollar weakness, an increase in market volatility, and a fall in bond yields provided support for the asset class, with persistent central bank buying another continuing tailwind for the metal.

As has been the case for many months now, interest rates are likely to remain in the forefront of investor minds as we look forward. The Swiss National Bank somewhat surprised markets last month by leading the charge among Western economies and cutting rates, although with less meetings scheduled than their counterparts their decision was only partly due to reduced inflationary pressures and partly to address the appreciation of the Swiss franc should other central banks move before them.

There is an increasing belief that the June to September range may be the most likely period for the Federal Reserve, European Central Bank, and the Bank of England to follow suit and begin cutting rates, though the factors we highlighted in previous months, such as wage growth-driven services inflation, supply and transportation constraints, geopolitical fragmentation, and the potential for further climate-related impacts over the summer months all remain reinflationary risks which investors and policy makers will need to watch closely.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.