With an objective to combat deflation and stagnant growth, for over 25 years interest rates in Japan have been at or around zero. Many investors, funds and companies have used this an opportunity to borrow large amounts from Japan and invest in US markets, receiving the benefit of the dollar’s appreciation vs the yen. Institutions, including hedge funds, have also participated in shorting the yen, often to protect their investments. These dynamics have been key factors in Japan being the largest foreign investor in the US. For Japanese companies, the weak yen has generally supported businesses but has had mixed impacts dependent on industry, composition of foreign earnings, and import costs.

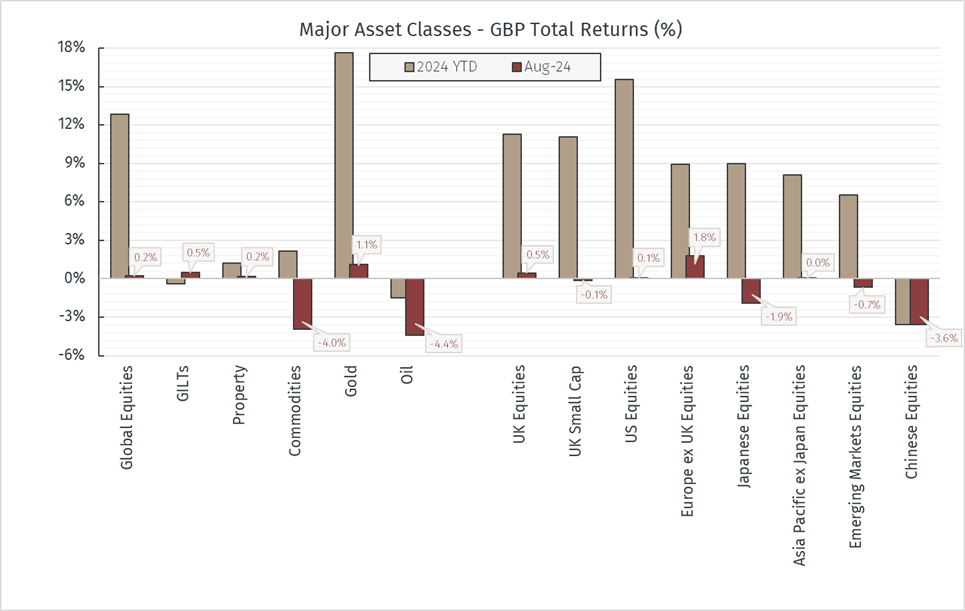

Following years of speculation on when the BOJ will begin to normalise monetary policy, in March 2024 the Japanese central bank raised interest rates for the first time in 17 years, increasing its benchmark rate between 0%-0.1% and ending nearly a decade-long period of negative rates. On 30th July 2024, in an announcement that surprised markets, the BOJ raised interest rates again to 0.25%, adding costs to existing loans and causing a knee-jerk reaction of institutions selling off assets to repay loans. Action from the BOJ coupled with US recession fears sent ripples through financial markets. The yen sharply appreciated vs the dollar due to a narrowing - and the prospect of a continued narrowing - of interest rate differentials between the two economies. The Japanese stock market saw a drawdown of 12.5% (-22.8% in local currency) and the US market detracted 6.5%. Throughout the rest of August, markets gradually recovered, ending the month with the US market at close to flat and the Japanese market down 1.9% (-2.9% in local currency). This followed reassurance from the BOJ governor that the central bank does not plan to raise rates further during periods of unstable markets combined with stronger economic data from the US in stronger than expected retail sales.

The combination of factors and speed at which events unfolded will have caused some deleveraging and unwinding of the carry trades discussed. It is likely that if these trends persist, we will continue to see market volatility in the areas that were impacted in early August. Investors need to keep the implications of this in mind, however as these moves are largely mechanical in nature and not based on company fundamentals, they will also provide opportunities for active market participants prepared to take advantage of shorter-term technical and indiscriminate sales of assets. On the fundamentals, valuations in the Japanese market remain compelling, and the catalyst of governance reforms have begun to bear fruit for investors, enhancing shareholder return yields.

In other markets, UK equities held up relatively well for the month, returning +0.5%. Sterling strengthened to the highest level vs the dollar since Q1 2022. With inflation and wage growth continuing to slow, the Bank of England (BOE) cut rates by 0.25% in August to 5% with an expectation for at least one more cut this year. European stocks delivered another strong month and led global regions in August. Inflation has continued to cool across the Eurozone, allowing more room for the European Central Bank (ECB) to cut rates. Aside from France, which saw a boost from the Olympics, Eurozone economic activity continued to be uninspiring in August. Forward-looking indicators have weakened across regions and sectors. Chinese economic and equity market performance continues to disappoint investors. The Chinese economy continues to struggle with falling real estate prices, a weak labour market, falling real estate and vapid consumer demand despite efforts from the Chinese government to reignite the economy.

Following what has been a relatively extended period of calm in markets, we are not at all surprised to see a return of market volatility in response to recent news flow. We continue to observe that certain market dynamics, sentiment and long-term cyclical trends often push capital to one side of the boat. As active and prudent investors we are committed to establishing where there is value in markets and aiming to avoid areas where the fundamentals do not support the investment case. We believe it is likely that near-term volatility will continue to provide dislocations and attractive entry points to underpin strong long-term returns for our client portfolios.