N.B. All performance percentages are in GBP terms unless otherwise stated.

Global Market Review – December 2023

Market insights

4 min read

Global Market Review – December 2023

Led by major Western economies, lower inflation prints and expectations of Central Bank rate cuts in 2024 led to continued strong performance across multiple asset classes, sectors, and regions in December.

LSEG Data & Analytics, 1 December 2023

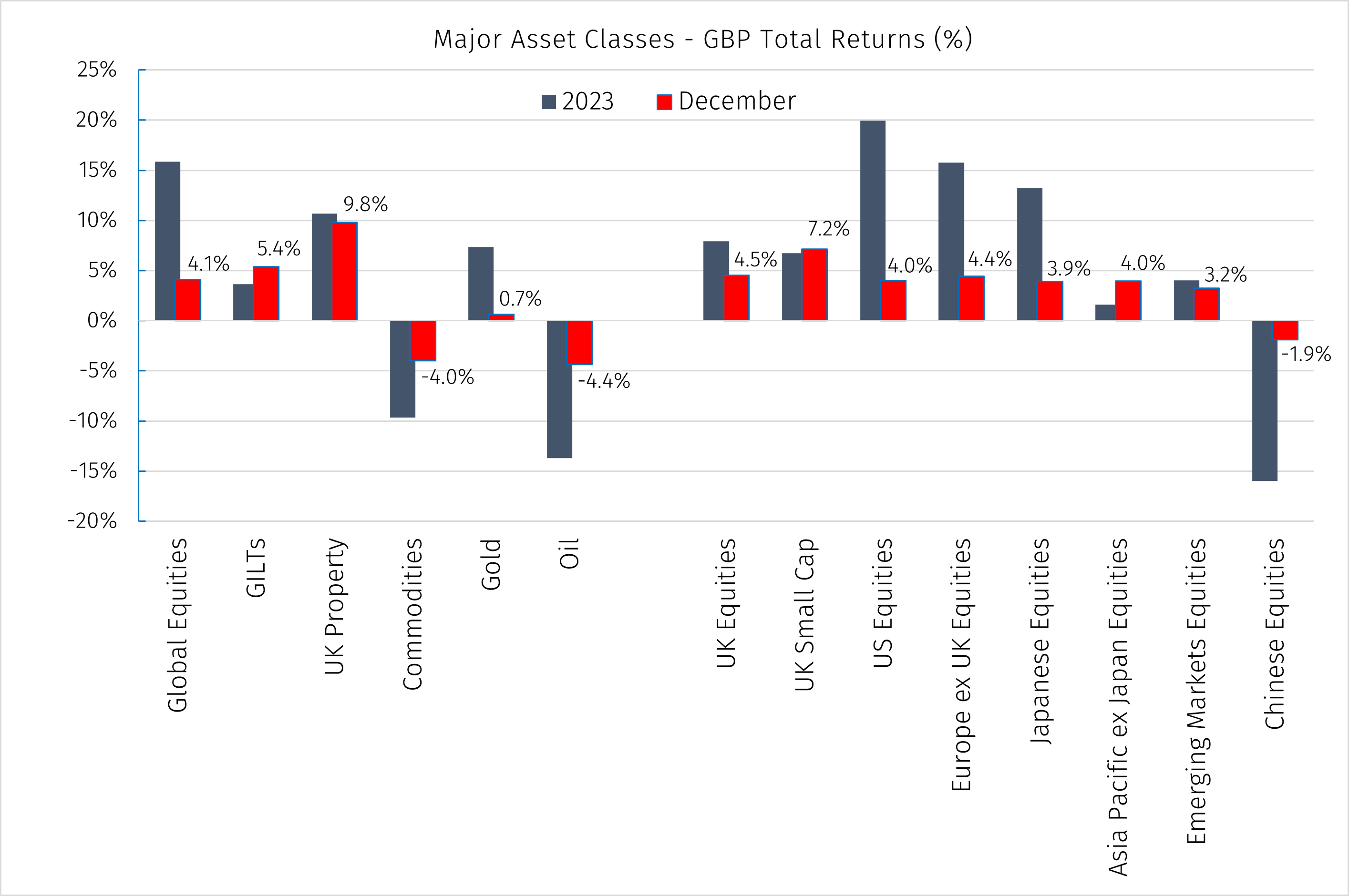

Economic soft landing momentum and Federal Reserve rate cut expectations drove US equities higher in December, extending the rally that began in November, with all US sectors except energy ending the month higher.

The S&P 500 closed-out 2023 with nine straight weeks of gains, the longest such streak since 2004, finishing the month just below its January 2022 record high. Over the month the market rally broadened with the equally weighted S&P outpacing its market cap-weighted sibling. The wider US market, as measured by the MSCI USA Index, ended the month +4.0%, and the small-cap Russell 2000 index posted its best month since November 2020 at +12.1% in local USD return.

UK and European equity markets also rallied higher for the second month in a row, picking up pace on their previous gains in November. A shift in central bank policy expectations away from the peak of the cycle to rate cuts supported risk appetite. Both the ECB and BoE talked up the importance of data dependency in the coming months, which fuelled speculation over rate cuts amid softer than forecast inflation and weaker economic activity.

The MSCI Europe ex-UK index ended the month +4.4%, and in parallel with its US counterpart – UK performance broadened wider across the whole market, with the FTSE All Share returning +4.5% compared to +3.75% for the FTSE 100. UK smaller companies showed particular strength with the FTSE Small Cap index climbing +7.2%.

Investors in Japanese equity markets cheered a dovish-leaning statement accompanying the Bank of Japan's decision to hold rates steady at -0.1% for the 65th consecutive meeting. Governor Ueda reiterated the bank’s need to see evidence that inflation will sustainably reach their target, and outlined their intention to wait for the outcome of spring wage negotiations before considering any potential abandonment of negative rates or changes to their yield curve control policy.

In turn, The Yen weakened, Japanese government bond yields sank, and Japan's equities rose sharply in the immediate wake of the perceived 'dovish hold', although much of this had reversed by month's end, with the TOPIX Index ending December +3.9%

Elsewhere in Asia we saw equity markets carry through the momentum from November on bets that major western central banks are done with rate hikes, and overall they followed the same pattern as in the west with gains being seen for the second consecutive month.

The regional ex-Japan index ended the month +4.0%, boosted by another strong month for Australia's ASX, which finished near 20-month highs. India was also strong with the Sensex reaching record highs in a broad-based rally. Currencies also rallied across the region as the dollar fell on declining US bond yields. This provided an extra tailwind to dollar-exposed markets, such as the Philippines and Indonesia.

The notable outlier in Asia remained China where the Shanghai Shenzhen CSI 300 index returned -1.9%, suffering its third straight month of losses on China's stumbling economic recovery, with high growth sectors underperforming markedly.

In correlation with equities, bond markets also rallied in December, particularly on the longer-duration end. As measured by the FTSE Actuaries UK Conventional Gilts Index range, UK Gilts over 15 Years returned +9.82% over the month, compared to +1.84% for those up to 5 Years. The total conventional Gilt index returned +5.41%.

US Treasuries also saw a big rally across the curve again, adding more fuel to the equity market rally as financial conditions eased further.

Mirroring what happened earlier in the year upon downside-surprise inflation figures, property funds saw strong share price performance over the month, with a number of UK Listed REITs providing double digit returns.

With the exception of a few idiosyncratic outliers on both the positive and negative side, expectations of lower capital costs in the coming year also resulted in infrastructure funds averaging mid-single digit performance.

Commodities, by contrast, were the downside outlier for December, with commodity indices largely impacted by some large movements, such as over 20% falls in USD fertilizer prices, European natural gas futures, and in the Bloomberg Orange Juice Index, in addition to a -4.4% movement in the oil price.

Industrial metal prices gained +1.2% led by USD iron ore (+4.6%) and copper (+2.6%), with precious metals rising 2.1% in USD term, buoyed largely by gold which sustained levels around all-time highs over the month.

Overall, December was a positive month for a wide array of assets, and in combination to previous returns from November led to a welcome end to a somewhat sluggish year where returns were previously quite narrowly contained.

As we move into 2024 all eyes remain on the potential pace of expected central bank rate cuts, together with several potentially influential national elections including the US, India, Taiwan, Mexico & possibly the UK. The inflation pressures which have been easing over 2023 are by no means in the rear-view mirror though, and we remain cautious that a number of unstable factors, not least international shipping concerns centred around the Red Sea, have the potential to see inflation return and further central bank action be required. Time will tell.

As always, remaining adequately diversified, with risk appetites and investment time horizons in mind remain a focus as we move into 2024. While there is cautious optimism in most markets, maintaining liquidity with the ability to pivot quickly should new opportunities or risks arise and is a primary factor to consider when continuing to navigate uncertain waters.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.