LSEG Data & Analytics, 1 March 2024

Market insights

4 min read

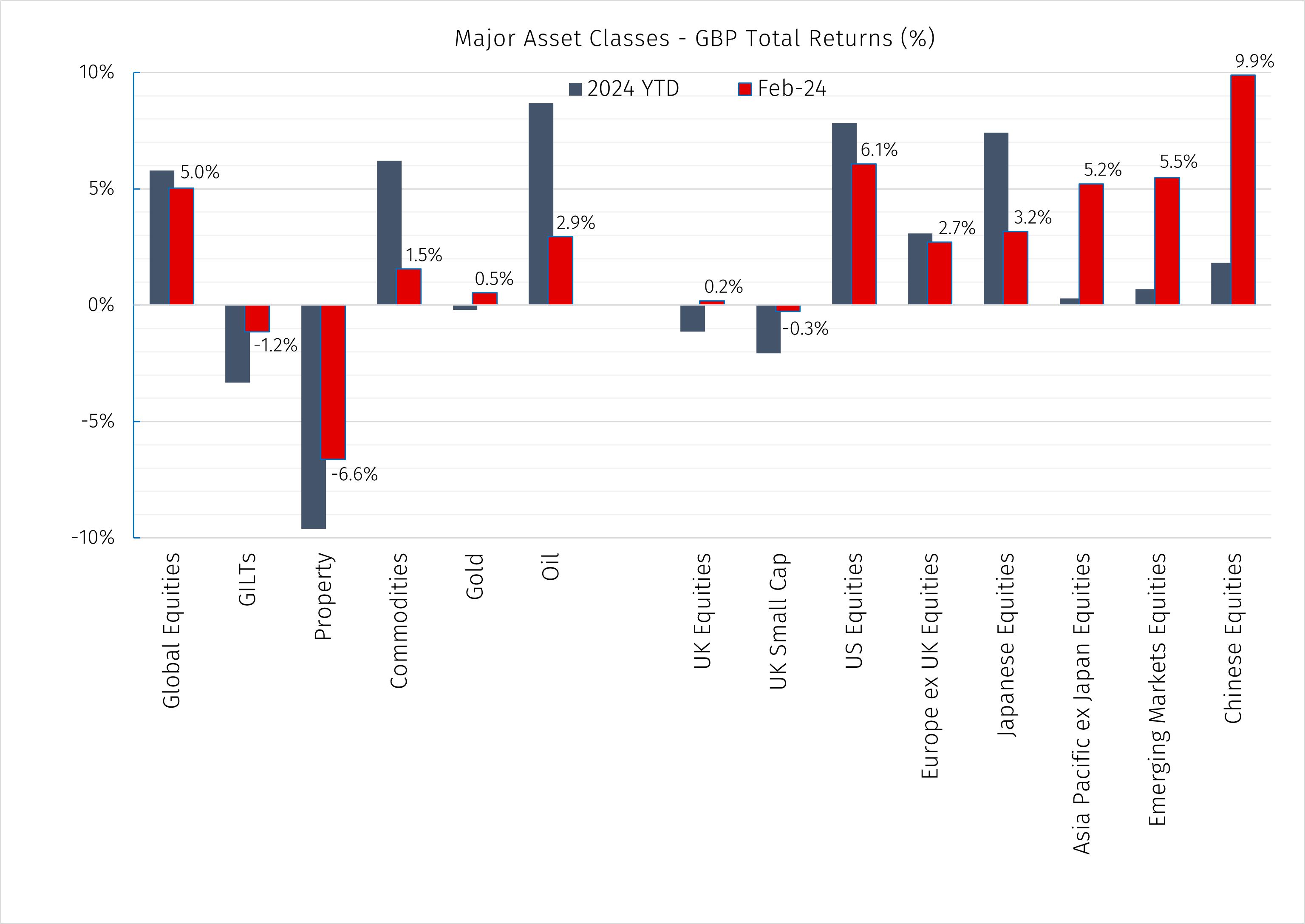

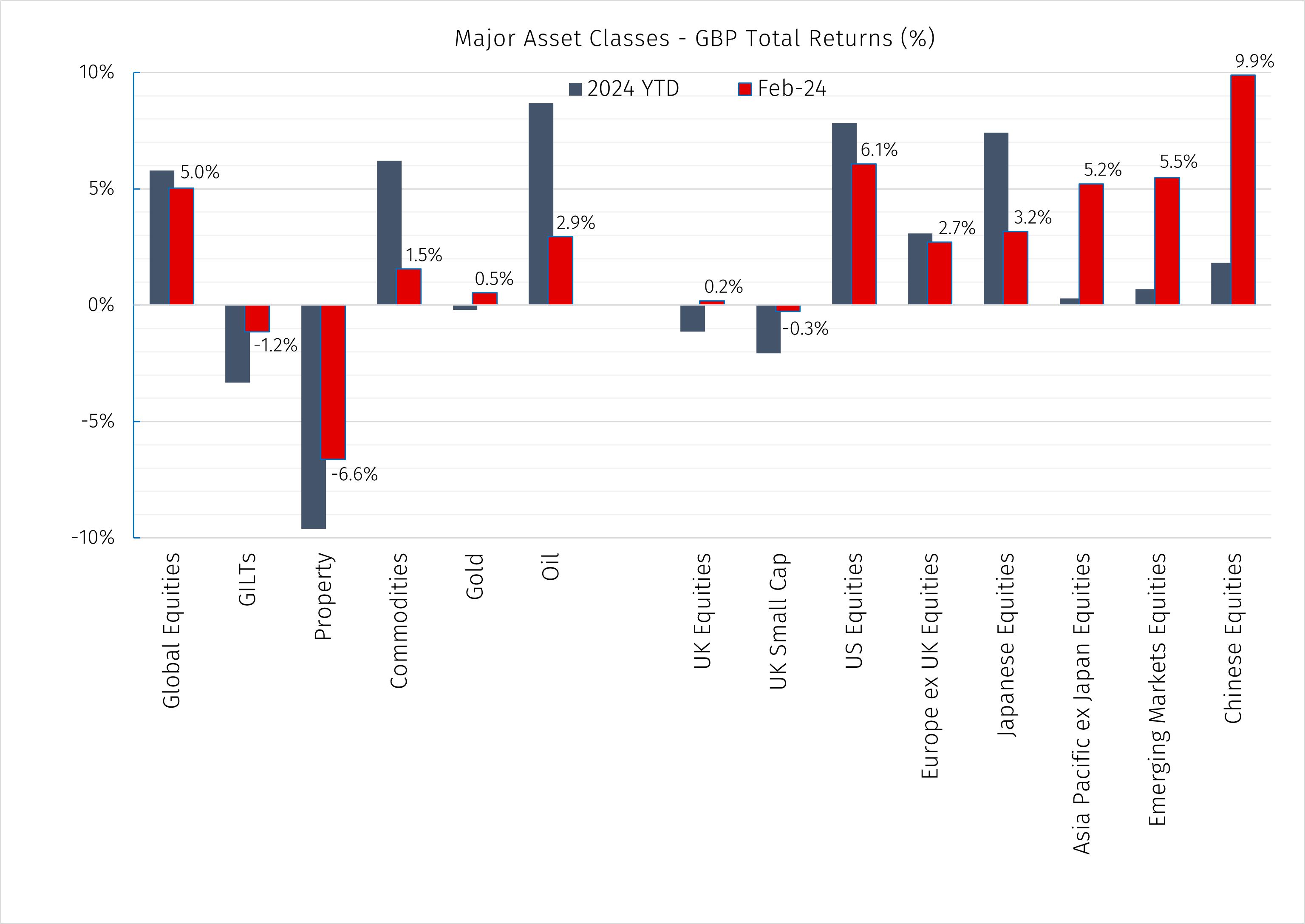

A positive month across most global equity markets, February saw a continuation of resilience in economic data and a convergence of views between major central banks and market participants on the potential pace of future interest rate cuts.

LSEG Data & Analytics, 1 March 2024

In the US, all eyes were on the release of the January CPI report which came in above expectations on both headline and core measures. Taken in combination with a trend of strong economic growth figures this initially raised some reinflationary fears, however the data indicated that at least some of the rise could be accredited to seasonal effects. Indeed, the February 29 PCE report (the Federal Reserve’s preferred measure of inflation) was cooler, and in line with expectations.

The US market provided the strongest regional developed market equity returns in February, with all primary sectors providing positive returns and the flagship S&P Index breaking above the 5000 level. The latest round of earnings releases was headlined by Nvidia, who again beat expectations and provided strong forward guidance leading to a $277bn market cap addition in on February 22, the largest single-day performance ever for any stock.

Despite the strong resulting rally in technology names, overall market performance for the month was actually led by the Consumer Discretionary, Industrials, and Materials sectors, showing that the broader market is starting to keep pace with mega-cap names. Performance within the Magnificent Seven companies is also showing strong divergence year-to-date, with Nvidia & Meta strongly outperforming the group with Tesla and Apple providing negative returns.

On both sides of the Atlantic small caps somewhat underperformed over the month. We continue to believe the current extreme level of divergence between small and large cap valuations represents an opportunity for long-term investors.

European equity markets finished higher for the fourth consecutive month with the STOXX 600 recording a new all-time high on February 23 before edging lower. This was led by the Automotive sector delivering double-digit returns, with Industrials, Construction, and Technology also contributing. Real Estate, Basic Resources, and Utilities were weak, and similarly to January the UK underperformed due to its skewed exposure to these sectors. This was in addition to pressure on leading property and infrastructure names on debt refinancing concerns.

It is not all bad news for the UK though, as despite receiving formal confirmation that the country ended 2023 in technical recession, the latest inflation figures which were predicted to show a small rise unexpectedly held steady and are predicted to fall in the coming months. Other forward-looking metrics such as service sector PMI data suggest that economically, the UK is already in recovery and outpacing the Euro area. With Chancellor Hunt announcing the latest budget in March, markets will be looking for the prospect of further fiscal support to support this recovery trend.

Japan is another area where focus remains on inflation and interest rates, although for different reasons than in western economies. The Bank of Japan is still waiting until the outcomes of wage negations in March, as well as evidence that inflation remains stable before considering a divergence from their long-held negative interest rate policy. Markets are speculating whether a rate rise could potentially be brought in this month or next.

Despite this, Japanese equity markets still ended the month higher, although performance was not as strong as other Asian and emerging markets, particularly China where market-supportive measures implemented in January and a step-up in technology stocks boosted gains. Investors have been wary on the sustainability of this rally, however, and point to the outcome of upcoming monetary and fiscal policy meetings in March as vital for gauging growth prospects for the remainder of 2024.

With the backdrop of indications that the Bank of England will be treading carefully regarding rate cuts, bond markets continued to weaken as yields continued their upward drift over the month. The yield curve remained inverted with the 2-year closing the month at 4.3% and the 10-year breaking 4% again for the first time since early December (closing the month at 4.1%).

Oil and broad commodities continued their strong start to the year, with European construction, US growth prospects, and the geopolitical landscape all assisting returns. Gold also remained stable, rising slightly over the month.

Looking forward, as has been the case for many months now, interest rates and the pace at which they may be cut over this year are likely to remain the key focus in the minds of investors. Despite markets proving somewhat “risk-on” in the opening months of the year, central bank committee members have continued to guide with a cautious tone, citing the possibly of reinflation risk.

There remain several factors contributing to the upside risk for inflation, including wage growth continuing to drive services inflation, a continued deterioration of geopolitical conditions, supply and transportation constraints, and climate related impacts. For many central banks the risk/reward argument may be more in favour of holding out a little bit longer and then cutting faster. Broadly speaking, markets have moved towards this line of thinking year-to-date.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.