In the US, at its meeting on 31 January the Federal Reserve appeared to leave its options open, removing some of the hawkish rhetoric from the meeting statement but also signalling that it may not be suitable to cut rates until there is greater confidence that inflation is sustainably moving toward the 2% target. While the odds of a March cut have become more unlikely, markets are still anticipating the first cut within the first half of 2024 and at least three in total this year.

The broader market momentum seen in December narrowed once again and although results across the companies was mixed, several of the ‘Magnificent Seven’ names continued to perform strongly. Tesla’s almost 25% decline was counteracted by gains in other names such as Nvidia (+24.2%), Meta (+10.2%), and Microsoft (+5.7%). Overall, underperformance within the MSCI US Index from sectors such as real estate, consumer discretionary, utilities and industrials was off-set by outperformance from technology, communication services, financials & healthcare to leave the index slightly positive come month-end.

European equity markets continued to benefit from expectations of central bank policy easing. President Lagarde hinted that policymakers at the European Central Bank were open to a rate cut in the coming months if data permits, while in the UK there was no suggestion of a surprise rate hike from the Bank of England ahead of their February meeting. Economic data in the Eurozone was somewhat subdued, particularly in Germany and France, but growth in Italy and Spain helped avoid a formal European recession. The UK economy continued to show underlying resilience with PMI data, business confidence, and consumer confidence all contributing to optimism on a soft-landing scenario playing out.

The technology sector led European performance over January, with standout performers ASML (+17.1%) and SAP (+15.2%) benefiting from increased demand and improved 2024 forecasts. Basic resources was the weakest sector, hampered by weak Chinese economic growth data. This contributed to underperformance in UK equities in particular, given the FTSE All-Share’s high exposure to energy and mining companies.

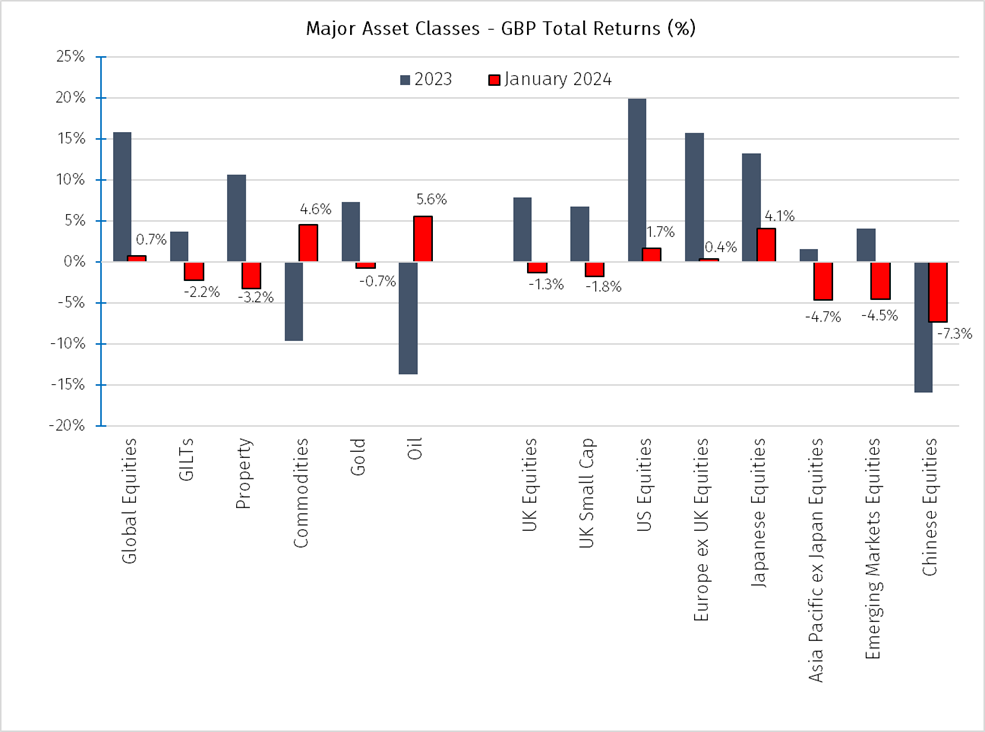

Despite uncertainty around the economic impact of a magnitude 7.5 earthquake hitting the west of the country on New Year’s day, Japan provided the strongest equity returns over the month, with the TOPIX Index again reaching record highs after gaining 4.1% in GBP terms. Markets reassessed the likelihood of a near term removal of negative interest rate policy as the Bank of Japan reaffirmed its intention to hold steady until they see evidence confirming both a positive wage/price cycle and sustainable adherence to their inflation target.

Asian and emerging market equities performed poorly in comparison to developed market peers, largely influenced by the US dollar strengthening after three straight months of weakening, as well as Chinese benchmarks touching lows not seen since the height of the Covid-19 pandemic.

Disappointing economic and property data was met with limited structural support measures as the People’s Bank of China instead focused on ways to bolster capital markets. Investors were somewhat sceptical of these measures as many economists still believe a consumer-focussed stimulus package is needed.

Bond markets saw geographic dispersion, with investor appetite remaining somewhat strong for European bonds amid a record amount of debt issued by sovereigns and corporates for January. However, in the UK and US, gilts and treasuries were mostly weaker as yields drifted higher over the month.

In contrast to the end of 2023, UK property and infrastructure funds largely suffered over the month, coinciding with a rise in gilt yields after UK inflation data for December surprised on the upside and hopes of an early rate cut waned.

Overall, commodities were the best performing asset class with oil in particular reversing a three-month slide to climb 5.6% in GBP terms amid Red Sea attacks disrupting shipping routes and targeted attacks on Russian infrastructure adding uncertainty to the global energy market. Gold dropped slightly after reaching previous highs, but demand remained stable over the month following some profit-taking.

Looking forward, the direction of interest rates and the timing of any cuts are likely to remain forefront in investor minds. Economic data has remained relatively stable across economies so far, particularly in the US, however risks to the soft-landing scenario that has arguably been priced in remain.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.