N.B. All performance details are in GBP terms unless otherwise stated.

LSEG Data & Analytics, 03 June 2024

Market insights

4 min read

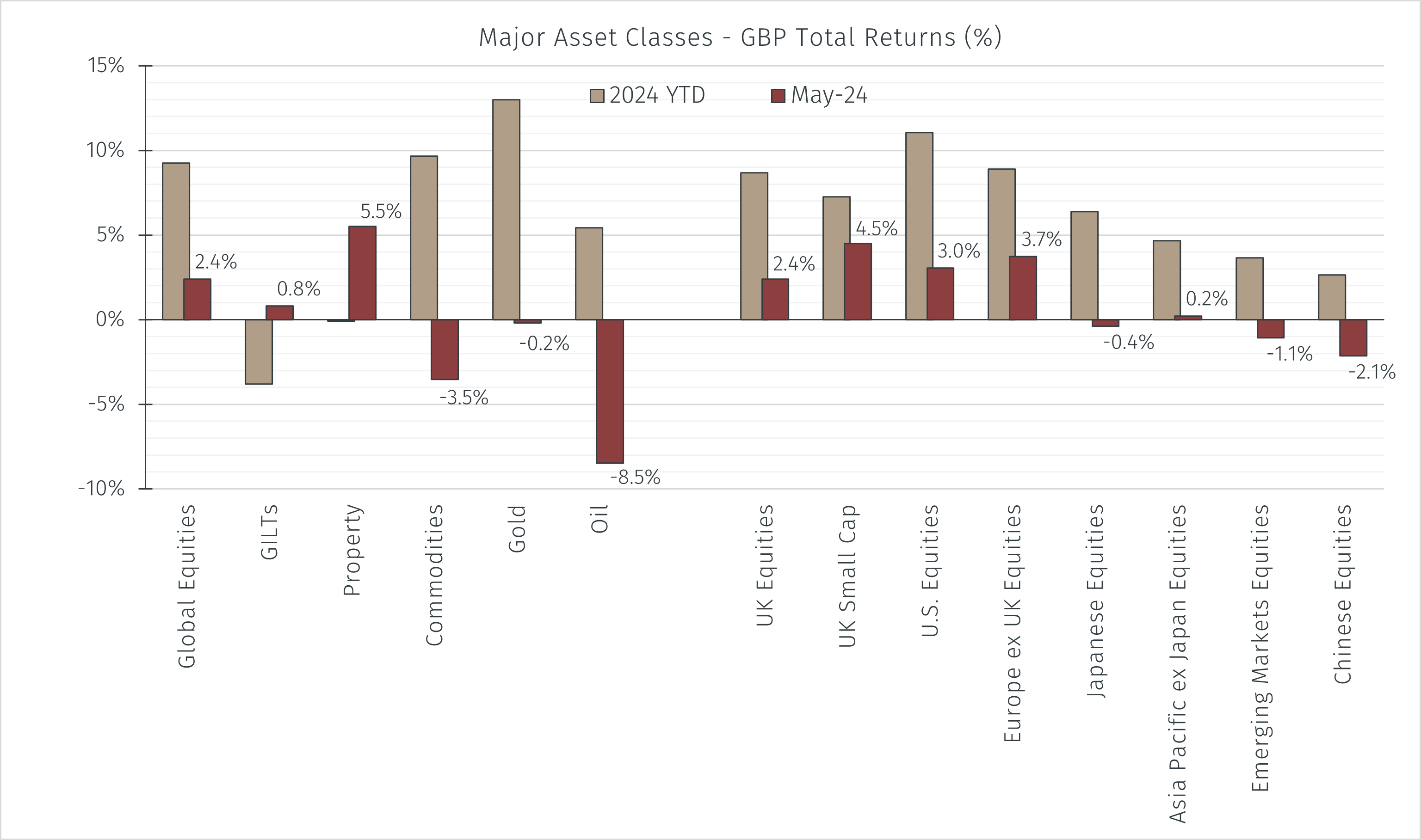

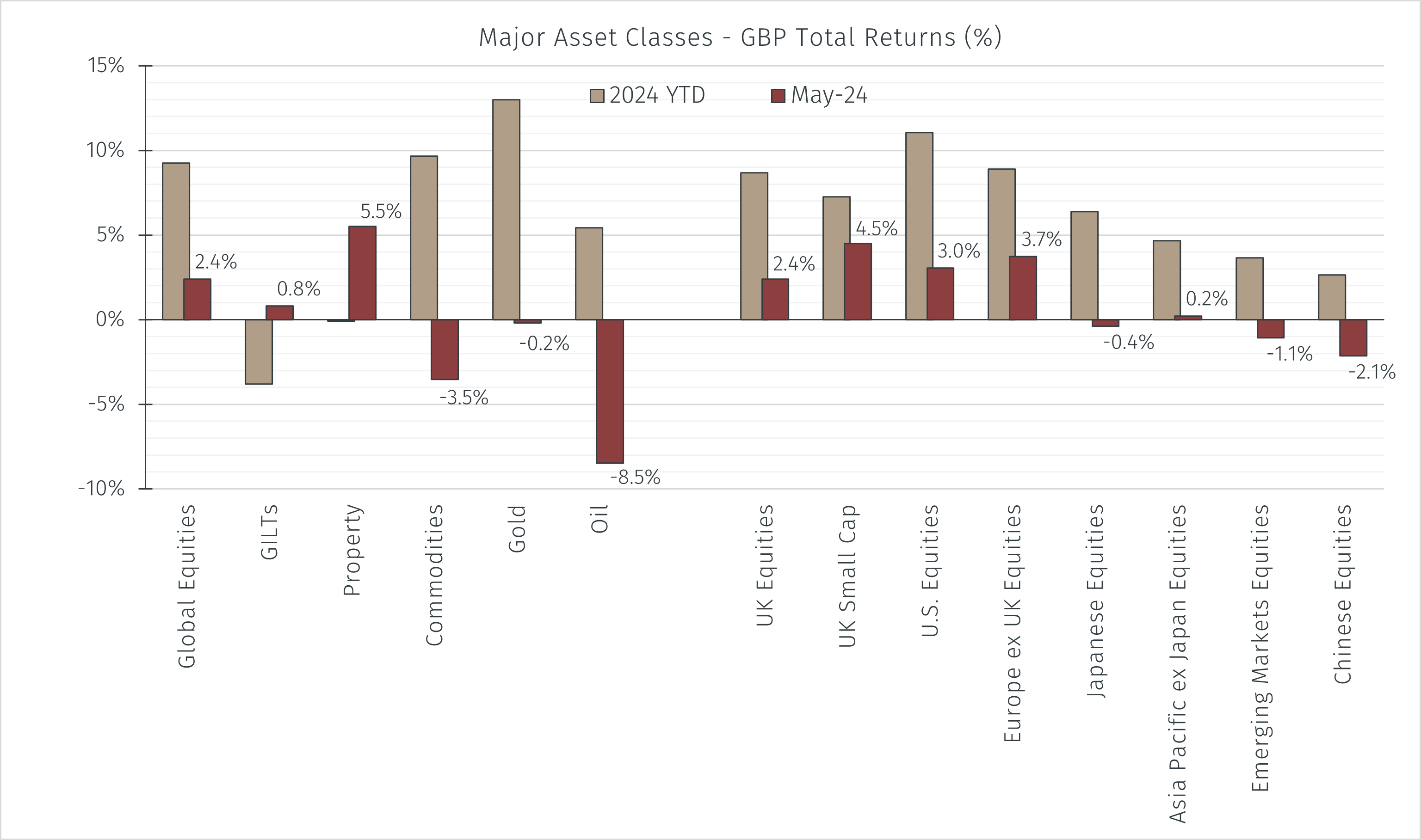

Following April’s pullback, developed economy equity markets rebounded in May, buoyed by a stronger than anticipated corporate earnings season.

N.B. All performance details are in GBP terms unless otherwise stated.

LSEG Data & Analytics, 03 June 2024

The phrase “Diversification is the only free lunch in investing” is attributed to Nobel Prize winning economist, Harry Markowitz. While the legitimacy of the adjective ‘free’ is up for debate given that diversification can be difficult and time consuming to achieve, the sentiment behind the expression rings true, and was evidenced in markets during May as areas of the market which had recently performed strongly de-rated, and others which had been weak recovered strongly.

U.S. equities provided multiple weeks of gains before consolidating in the last week of the month. Mega cap tech stocks again logged outsized performance, with NVIDIA (+26.8%), Apple (+12.9%), Microsoft (+6.8%), and Alphabet (+6.0%) contributing more than half of the S&P 500's gains in May. Whilst these names drove the overall index, their narrowness led to a revival of concentration worries, with the equal-weight S&P 500 index lagging behind the more commonly followed market capitalisation weighted gauge of the U.S. market.

Inflation and interest rates remain a significant focus for U.S. market sentiment. The latest U.S. core PCE inflation figure released in May was in-line with expectations at 0.25% month-on-month and 2.8% year-on-year. The Federal Reserve has stressed that core PCE remains the key input for their interest rate debate, and while the year-on-year level is still above their 2% target, the lack of upside surprise was taken as a positive. Market consensus suggests that core PCE prints in the 0.2-0.3% range over the coming months may keep the prospect of a September rate cut in play, especially if the EU and UK begin their rate cutting cycles over the summer.

European & UK equities also performed strongly, with both the STOXX 600 and FTSE 100 registering new record highs during the month. On the continent, positive earnings reports in the banking sector, good economic data, and European Central Bank rate cut expectations drove the market. In the UK, comparatively upbeat economic forecasts and increased takeover activity helped curtail institutional money outflows and support liquidity levels.

UK Small Cap stocks were a particular area of strength, boosted by a stronger than expected Q1 GDP reading which showed a 0.6% increase. PMI data also pointed to a continuing expansion, albeit with a slower rate of growth than previous months due to a slowdown in service sector PMI. This activity growth has, however, fed into concerns that the UK could witness a slower process of cooling inflation. UK headline inflation eased to nearly three-year lows at 2.3% last month, but the core reading and services prices remained sticky.

Japanese equities traded broadly flat over May, ending the month -0.4% largely due to currency fluctuations. Currency factors and elevated inflation also impacted Asia Pacific ex-Japan equities, which were also flat over the month. Weakness in countries like Indonesia, South Korea, and the Philippines was offset by strength in Taiwan whose outsized technology sector rose again following strong corporate earnings stemming from AI investment.

China also dragged on Asian equity performance, as following gains in previous months Chinese equities pulled back in May. This move coincided with renewed outflows as Bloomberg-compiled data showed ETFs in Shanghai and Shenzhen experienced withdrawals worth USD4.2bn in the first three weeks of the month. This was the first such outward movement since February 2023 and equated to more than twice the inflows of the two preceding months. Reasons noted for the outflows include an underwhelming local earnings season, doubts surrounding the effectiveness of the latest property sector rescue measures, and elevated trade tensions following US tariff hikes.

Emerging Market equity indices also drifted lower over the month. In addition to Chinese weakness, performance was also dragged down by the Brazilian market, whose largest constituent Petrobras fell alongside oil price declines. Mexican and South African equities also suffered a volatile month amid electoral uncertainty.

Gilt yields initially dropped in May, then rose back over later weeks to end the month at slightly higher levels than where they began. This shift corresponded with market belief on the likelihood of the Bank of England implementing a June interest rate cut falling to below 20%. Gilt price performance was modestly positive over the month, with the ICE BofA UK Gilts All Stocks Index gaining 0.8%, however this was scant news for gilt investors as the asset class remains the worst performer year-to-date.

Property was a positive outlier among alternative asset classes, with the FTSE EPRA Nareit UK Index rising 5.5%, recouping all of its previous 2024 losses. Despite the persistence of attractive ‘risk-free’ yields, confirmation that the UK rebounded relatively strongly from a shallow recession at the end of 2023, along with ongoing supply constraints in key regions and a continuing prevalence of corporate activity led to multiple areas of the UK listed real estate market gaining significant attention from public and private equity investors alike.

The gold price remained elevated in May, again touching all-time highs in USD terms, however the metal traded largely flat over the month. This was not the case for broad commodities, however, with the S&P GSCI Commodity Index falling 3.5%.

Oil exacerbated this fall, with Brent Crude prices dropping 8.5% over the month. Inventories remain stable following a largely warm winter period, and demand from Chinese and European refineries remains lacklustre. Demand is still expected to outpace supply during the summer months, not least through an increase in merchant shipping fleets navigating longer journeys to avoid the Horn of Africa and Red Sea regions. Indications from the Federal Reserve that U.S. interest rates may remain higher for longer may somewhat challenge hopes of a rebound in U.S. oil demand over the second half of the year, however. Future prices may also be influenced by OPEC+ signalling plans to begin slowly phasing out voluntary production cuts from September, though this taper timeline remains data dependant and subject to review. There is belief that the timeline for the reversal of production cuts will be extended should fundamentals not be favourable later in the summer.

As we are often reminded, one thing that markets loathe is uncertainty. There are numerous macro factors under the spotlight over the coming month, not least the impending result of the Indian general election, the European Central Bank revealing its latest rate decision, the run-up to a snap UK election in July, and the tentative potential for a U.S. led resolution to the ongoing war in the Middle East.

The outcomes of these dynamics may go some way to removing some of the current top-down uncertainty in markets, but with reinflationary risks to the future path of interest rates persisting, as well as geopolitical pressures remaining on multiple fronts, we remain cautious in our near-term outlook. We do, however, continue to observe what we believe to be attractively priced opportunities in the market where value can be unlocked over the medium-term.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.