N.B. All performance details are in GBP terms unless otherwise stated.

Global Market Review – November 2024

Market insights

4 min read

Global Market Review – November 2024

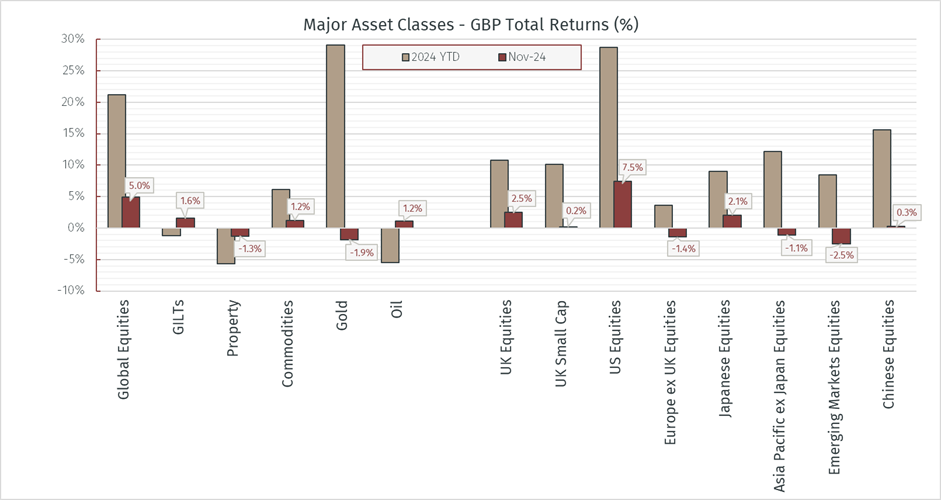

November generally proved to be another positive month for financial markets. US markets led global equity returns as the resurgence of the ‘Trump Trade’ helped the S&P 500 Index finish the month higher for the ninth time this year.

Source: LSEG Data & Analytics via EFG Asset Management, 01 December 2024

The decisive Republican victory in the US election, winning majorities in both the Senate and House of Representatives along with the Presidency, removed a level of uncertainty from markets, driving both the US dollar and US equity markets stronger over the month. Strong breadth of performance was observed, with smaller companies and the banking sector in particular benefitting from the prospect of corporate tax cuts and an expected shift towards deregulation in the incoming Trump administration. While the initial reaction in the US equity market has been positive, it remains to be seen if this is a case of market participants ‘buying the rumour’, and if they in turn may ‘sell the fact’ after Trump officially takes office and the demand for results increases.

The election result did bring with it some concerns, particularly around the expected rise in the level of the US fiscal deficit and the potentially growth-stunting potential of trade tariffs which the President-elect appears eager to implement. While Trump does have a history of using aggressive tariff threats as a negotiation tool, the probability of a re-intensification of trade tensions remains a wild card and a key risk for 2025. Several unknowns remain on the magnitude of tariffs imposed, the countries impacted and on which products. We expect this to be an area that is top of mind for investors as new information enters the public domain and further clarity on policies is provided. With the level of US Government Debt equal to 122% of the country’s GDP in 2023, and projected to rise over this and coming years, there is an economic challenge facing the new administration. It has, in part, reacted to this by announcing the establishment of the Department of Government Efficiency, led by Elon Musk and Vivek Ramaswamy, which will aim to cut federal spending, the size of the government and the size of the federal fiscal deficit. With Trump’s plans to implement major tax cuts potentially exacerbating the current deficit, it will be interesting to monitor the new advisory department’s influence over the coming months.

UK equities were also positive over the month as markets digested the fallout of the autumn budget and identified potential winners. Many companies across the industrials, finance, and consumer goods sectors posted double-digit monthly returns. As we noted in last month’s commentary, UK gilt yields rose following the release of the autumn budget as bond investors became concerned about the level of government borrowing required over the coming years. Yields subsequently eased as November progressed, with 2-year and 10-year gilts ending the month yielding around 4.2%, however these levels remain higher than they were over the summer, despite the Bank of England’s base interest rate having been cut. While we have seen good progress towards paring inflation over the last 2 years, it is clear that reinflationary concerns persist on both sides of the Atlantic, which could prove to be a headwind for property and other interest rate sensitive assets.

European markets saw a mixed month, with political factors influencing returns. With the prospect of US trade tariffs, ongoing French budget woes, the collapse of the German ruling coalition, escalating tensions between Russia and Ukraine, and mixed economic growth and inflation data, there are multiple factors which suggest elevated levels of volatility in the region can be expected over the near-term.

Japanese Q3 growth data was released in November, and while it was softer than expected it did still reverse the contraction previously seen in Q2. Following on from October, Japanese equity markets remained largely rangebound over the month, however the yen continued to depreciate, leading to a positive return for sterling investors. Similar to Europe, the political environment has also been somewhat uncertain in Japan over recent months, however, in contrast to Europe the Japanese macro backdrop remains much more robust, which we feel is more likely to support equity markets over the medium-term.

Elsewhere, other Asian and emerging market equities were weaker in November, particularly in US dollar- and trade-exposed regions such as Southeast Asia and Latin America. There were still pockets of strength, such as Australia, where IT names helped the ASX reach record highs over the month, and Singapore, where strong gains in banking names helped the index reach 17-year highs. Chinese stocks were mostly flat following mixed economic data and a continued trickle-down approach to government stimulus, Chinese leader are likely awaiting further clarity on the true level of tariffs Trump’s team may apply on Chinese goods before committing to more meaningful action.

Commodity returns were subdued in November, largely influenced by the oil price remaining largely flat over the month. Looking forward, President Trump is expected to ease restrictions on the US domestic oil industry, though the larger impact he could have on global supply/demand dynamics, and ultimately the oil price, could potentially come from the level of potential import tariffs, his dealings with Russia regarding the war in Ukraine, and more aggressive sanctions on Iran. The gold price also saw some consolation following an exceptional run. Despite the ongoing demand drivers for gold, including increasing geopolitical risk, lower real rates and central bank buying, some consolidation after such as strong run is to be expected.

Although we are vigilant to the developing risks in global markets, our central thesis and the essence of our investment approach are unchanged. We believe that an investment process that is centred around fundamental analysis, but also accounts for potential macroeconomic risks through purposeful diversification, should be best placed to deliver attractive risk-adjusted returns. Our bond allocations continue to serve a purpose as protection against growth stocks while providing attractive yields again. We also believe real assets such as commodities continue to play an important role as protection against inflation shocks. Within equities, we are mindful of concentration risk, the potential for excessive optimism and higher premiums in certain areas of the market. Although valuations are not always a useful timing tool, history has repeatedly reminded investors that the price you pay matters.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.