N.B. All performance details are in GBP terms unless otherwise stated.

Global Market Review – October 2024

Market insights

4 min read

Global Market Review – October 2024

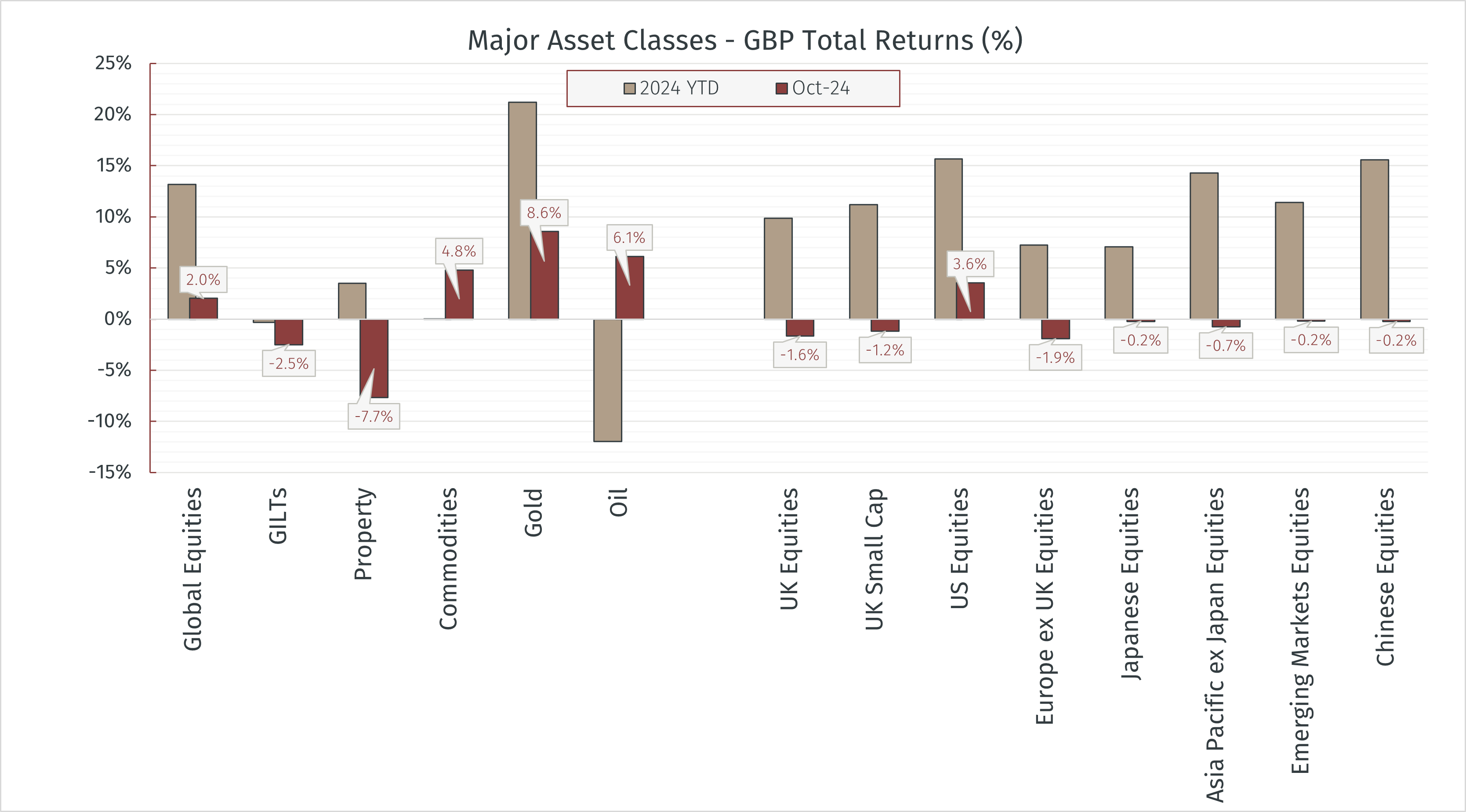

October proved to be a volatile month for investors in the run up to two high-profile events – the UK Autumn Budget and the US Presidential Election. All major equity regions other than the US detracted over the month, with US equity returns boosted by a resurgence of the US dollar for sterling investors.

Source: LSEG Data & Analytics via EFG Asset Management, 01 November 2024

Uncertainty around fiscal policy decisions on both sides of the Atlantic contributed to sharp increases in bond yields over the month. 10yr treasury yields rose from 3.7% to 4.3% and the 10yr gilt yield from 3.9% to 4.5% in what was a tough month for bonds and interest rate sensitive assets. Property pared back some of the recent gains in light of the spike in yields. Gold continued to buck the trend, rising 8.6% over the month despite the usual relationship of downward pressure from increasing yields and a strong dollar. Other than gold naturally being an asset of choice in uncertaintly, we believe central bank gold purchases continue to be a key factor here, as nations hostile to the west continue to look to diversify their reserves away from dollars. Central bank gold buying hit a record high in the first quarter of 2024, according to the World Gold Council.

UK Autumn Budget

On 30th October, the Labour government communicated its first budget since taking office in July. This brought to an end several months of speculation about the future direction of UK taxation and spending. The budget delivered large increases in spending, borrowing and taxation, the result of which is likely to give at least a short-term boost to UK GDP. There are, however, warranted concerns as to any associated rise in interest rates and upward pressure on inflation, the latter likely to be indirectly influenced by National Insurance increases as well as the impact of fiscal expansion. On the afternoon of the Budget, the price of the UK’s benchmark 10-year gilt fell, sending yields higher by almost a quarter of a percentage point.

As widely anticipated, the budget dealt a blow to savers, employers and investors. On capital gains tax, the lower rate of CGT moved from 10 to 18% and higher rate from 20 to 24%. Employer National Insurance contributions will increase by 1.2% to 15% from April 2025, a cost many expect could be passed through to consumers in the form of higher prices. We also saw a move to increase stamp duty land tax on second and rental properties from 3% to 5% which could have a significant impact on this element of the property market further increasing the high frictional cost of transactions.

Regarding IHT, the government is removing the option for individuals to use pensions as a vehicle for inheritance tax planning by bringing unspent pots into the scope of inheritance tax from April 2027. For the AIM market, the announcement was mixed. It was feared by many that business property relief for AIM companies would be removed completely, however under the new rules an AIM portfolio is liable for tax, but at 20 per cent rather than 40 per cent. This was welcomed by the market on the day, with the FTSE AIM All-Share Index up 4%. While we are disappointed with the reduction in business property relief, clarity on the current position for investors and the fact that the relief has not been removed completely are positives to take here.

UK equities fell over the month and have continued to be weak since the budget annoucement. The budget was judged by many to have limited long-term benefits for productivity and it has also impacted the interest rate outlook, reflected in rising yields. On the positive side, recent labour market data has shown good employment growth, wage growth that is high but clearly slowing, and an inflation rate that has fallen below 2%.

US Election

The run up to the US election was one of the most polarising on record, with polling extremely tight and the result expected to be on a knife-edge. For investors, the key factors were based around taxes, trade, immigration, and regulation. The foundations of Trump’s agenda have been built on on tax cuts, reversing immigration, protectionist tarrifs and reducing regulation. In contrast, Harris’ agenda involved tax increases, a larger degree of regulatory intervention and a more balanced trade policy.

In light of the result, the apparent Republican clean sweep has been a positive for equity markets so far. President Donald Trump won every swing state with Republicans also winning control of the Senate. While the House of Representatives is still undecided, markets are leaning towards Republicans winning with a slight majority. Regardless of one’s view of the outcome, certainty the day after polling will have been a positive for the US markets and economy short-term. Bond markets fell as investors anticipated higher levels of borrowing, tariffs, a slower pace of interest rate cuts and higher inflation. In terms of immediate winners and losers, small cap US stocks have seen a boost, with the Russell 2000 up 7% since the result. The main losers are perceived to be countries on the end of Trump’s proposed tariffs, most notably Mexico and China.

Elsewhere, European stocks were not immune from the market volatility in October and were weak over the month, particularly within real estate and technology. Europe has continued to struggle to generate economic growth, but signs that inflation was still present tempered central banks’ ability to lower interest rates, with the European Central Bank (ECB) cutting rates by 25bps in October. A slower cutting cycle appears likely in light of services and core inflation remaining above target.

Japanese eqities were rangebound for the month but were an outperfomer in local currency terms (1.9% positive return in yen terms). The Bank of Japan has continued to reiterate its hawkish policy stance, however the yen depreciated nearly 6% against the strong US dollar, leaving the yen back at levels last seen in May. The weakness of the yen supported large caps, industrials and autos. Macro conditions in Japan remain robust and the Bank of Japan indicated they may take action in their December meeting.

Asia and emerging markets indices saw pressure from the US dollar and the assumed impact of a Trump presidency. Optimism that had been triggered by China’s announcement of a broad stimulus package waned as investor attention was drawn to the prospect of a Trump victory. Indian equities have been correcting sharply in October predominantly due to weak corporate results. Taiwan was the only Asia/EM country to deliver a positive return in October, supported by ongoing positive sentiment around artificial intelligence.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.