Initially, inflation had a direct impact on the property sector, triggering higher costs for building materials and energy, however these pressures alleviated later in the year. Financing costs for property projects increased, reducing overall returns at a time when investors' expectations on risk-adjusted returns have risen due to higher bond and equity yields.

Investing in real estate

Learn

3 min read

Investing in real estate

Last year the global economy experienced a period of rising interest rates and elevated inflation; this resulted in commercial real estate transaction volumes falling by 50% compared to pre-2022 levels.

Commercial property around the globe

Central banks continued to raise interest rates throughout 2023 to combat inflation. Globally, annualised inflation has slowed, and we expect this to continue throughout 2024.

Since mid-2002, yields in the commercial property market have increased by 0.5-1.5%, influenced by geographical, sectoral, and location-related factors. Market participants are generally confident that the property investment landscape is improving. Based on survey results conducted between investors and managers, property values are predicted to reach their lowest point in 2024.

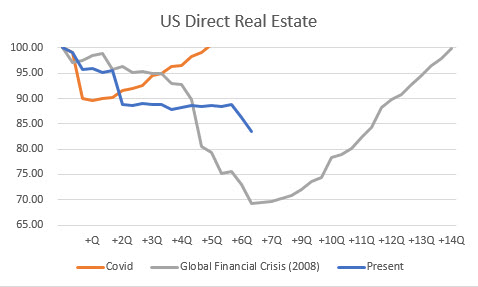

Whilst difficult to predict, we believe we are currently close to the length of the last commercial real estate decline during the global financial crisis, but with lower debt levels, longer debt maturities and a higher proportion of fixed-rate debt in the sector today.

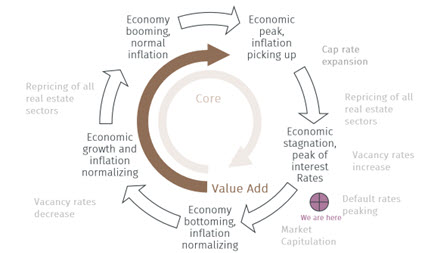

Real estate cycle and suitable real estate strategy

Source: EPRA, Factset

Real estate correction and recovery (Direct Property Index, US)

Source: CPPI November 2023

Commercial property as an asset class

Investing in property directly can lead to liquidity risk. To benefit from property investments, whilst having the flexibility of stocks, investors may opt to include real estate investment trusts (REITs) in their portfolio.

REITs provide opportunity to invest in real estate, without the large, initial injection of cash. As with stocks, REITs are exposed to market, economic and inflationary risk, however investors can maintain a diverse portfolio, without being limiting to one property.

Important information

Volatility can be a concern for investors, and it is important to assess your investment time horizon and attitude to risk. Your Investment Manager is always available to discuss the allocated investments and performance of your bespoke portfolio as required.

For further information, download a copy of the latest Commercial Real Estate Outlook 2024 from EFG Asset Management.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest.