It is frequently said that remaining rational and unemotional is a key facet of successful investing. While this sounds reasonable in theory, we, as humans, are inherently emotional beings. These emotions clearly impact our personal risk tolerances in down markets; however, one often-underappreciated aspect of behavioural finance is the other side of that same coin – overconfidence when the tide turns in our favour.

An often-discussed psychological phenomenon which impacts many investors is the Dunning-Kruger effect, a cognitive bias coined in 1999 by psychologists David Dunning and Justin Kruger wherein individuals with low ability or understanding in a particular area tend to overestimate their own skill or knowledge in that field. In simpler terms, those who lack expertise in a specific area are often unaware of their incompetence and may even believe they are more skilled than they truly are. It has been described as “learning the letters A, B, and C and then assuming one knows the entire alphabet”.

This effect is seen in many areas of life when a person's lack of knowledge, experience, and skill in a certain area causes them to overestimate their own competence. By contrast, it also drives those who excel in a given area to think that task must be simple for everyone, leading them to underestimate their abilities.

Understandably, being aware of this bias and how it may affect your decision making is critical when it comes to sound investing, as knowing when to take risk, and arguably more importantly when not to take it, is paramount.

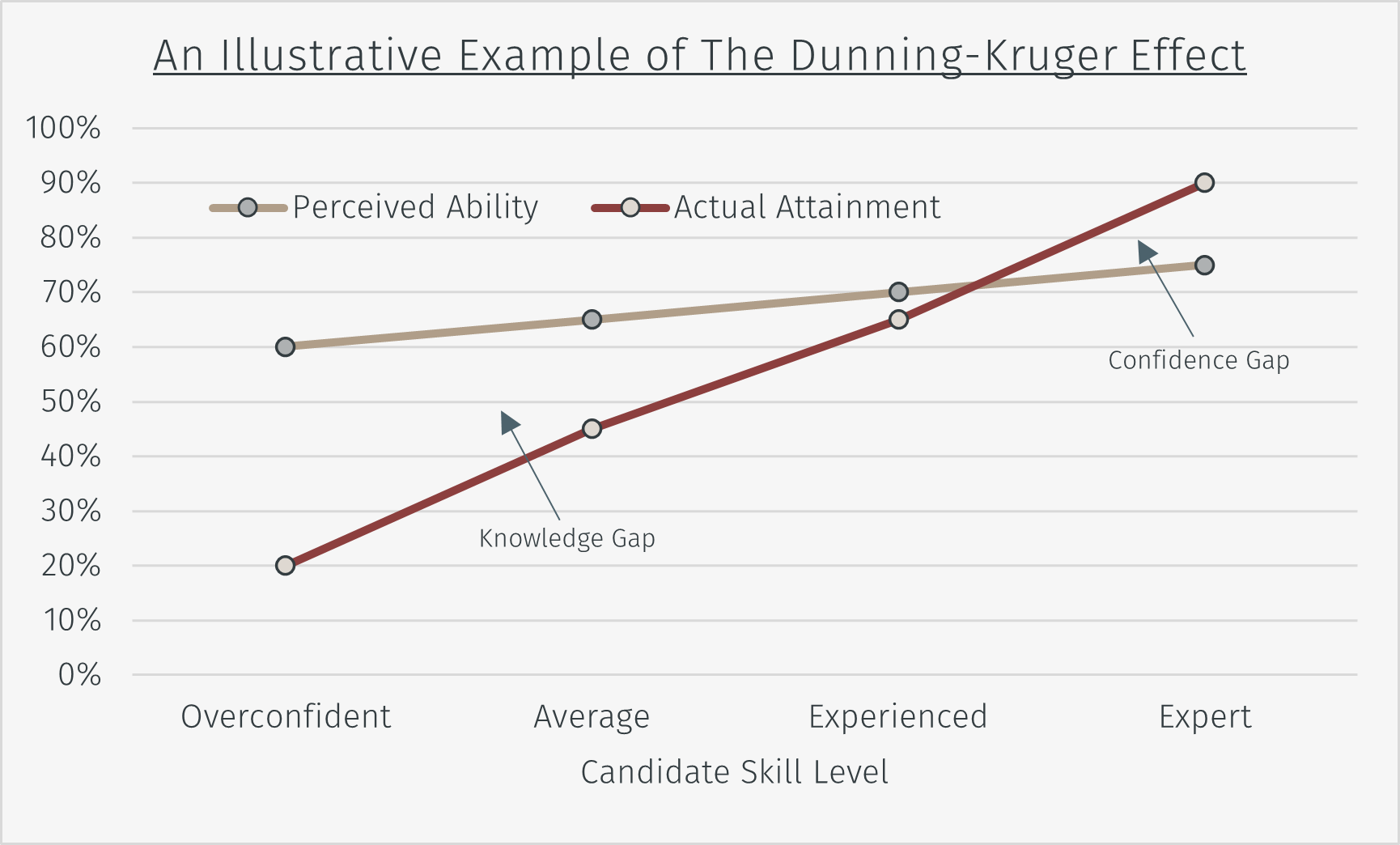

The adjacent chart shows an example of the Dunning-Kruger effect in relation to perceived ability vs. actual attainment on a typical series of test scores. It shows how the “knowledge gap” in less skilled candidates can turn to a “confidence gap” in those with greater expertise.

Image created for illustrative purposes only