N.B. All performance details are in GBP terms unless otherwise stated.

Global Market Review – December 2024

Market insights

4 min read

Global Market Review – December 2024

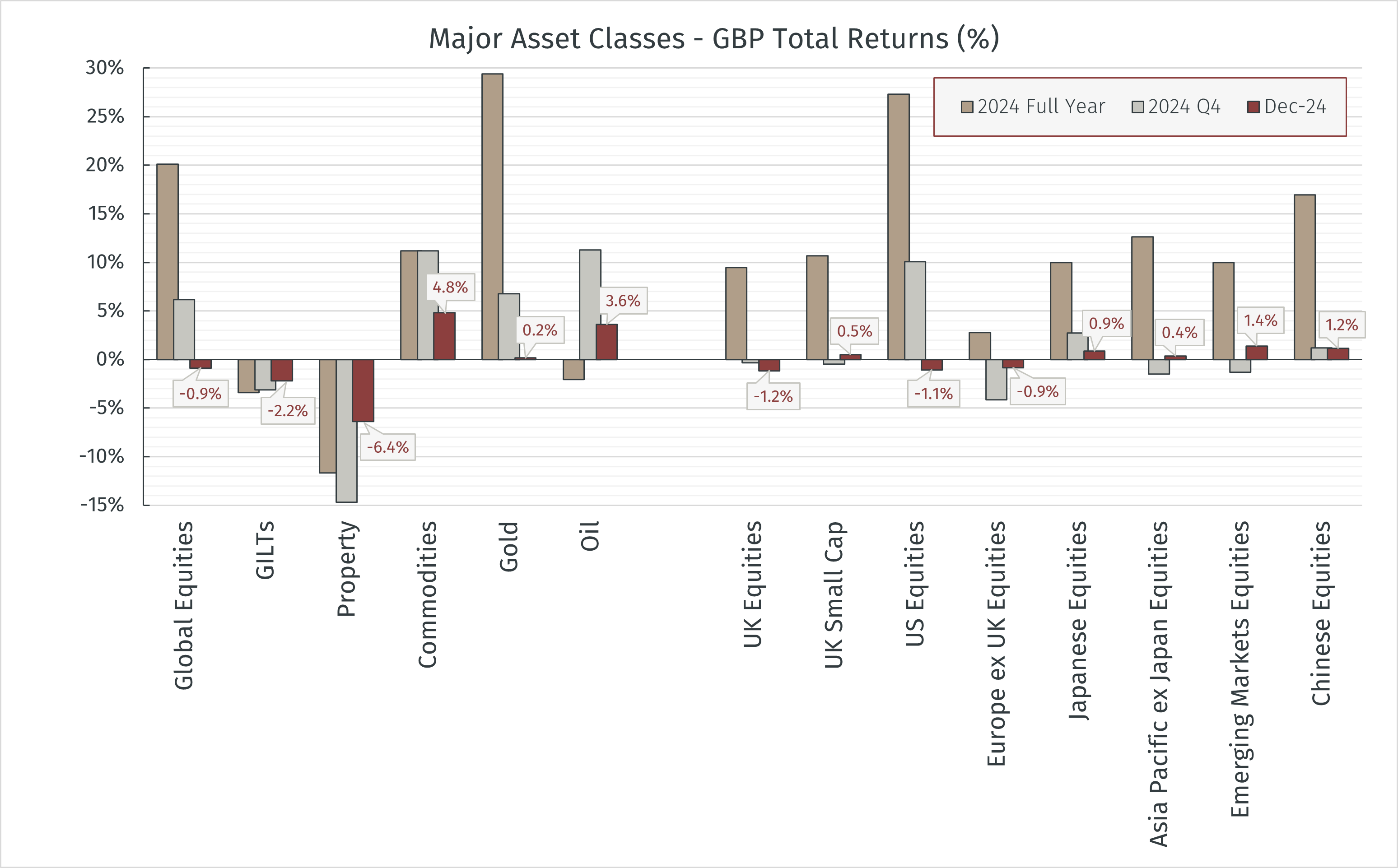

A combination of US dollar strength and rising bond yields led to subdued performance across most asset classes in December, however this did little to pare strong overall yearly returns for global equities and gold.

Source: LSEG Data & Analytics via EFG Asset Management, 02 January 2025

In the US, despite December regularly producing positive returns over the past two decades, the anticipated ‘Santa Rally’ didn’t materialise this year, with stocks ending the month 1.1% lower. Some of the selling activity could be attributed to tax-loss harvesting, similar to what we observed in December 2022. The detraction was relatively insignificant when compared to 2024 fourth quarter and full-year performance, with the US leading global equity markets, ending the year with a 27.3% overall gain.

Following a pause in November, the dollar index resumed strengthening against other major currencies in December, advancing to new highs in light of hawkish commentary following the Federal Reserve’s 18 December 0.25% interest rate cut. As the dollar remains the world’s primary reserve currency and the most liquid global exchange medium that most assets are traded against, more often than not it tends to put strain on asset prices when it strengthens. Although all assets will always have idiosyncratic factors affecting them, the strength of the dollar goes some way to explaining December’s relatively muted performance across global equity markets.

The strongest equity returns over the month came from emerging markets, particularly China, after Beijing announced plans for CNY3T ($411B) in special treasury bond issuance throughout 2025 to recapitalise its banks and support consumption, a move that more than offset the latest weak economic data release.

The Japanese equity market also advanced in December. Despite foreign policy influences, the Bank of Japan’s dovish stance contributed to a weakening of the yen, enhancing the competitiveness of the country’s many large exporters. Along with the weak yen, the market was driven by talks of large mergers in the automobile industry, causing Japanese automobile stocks to tick up and pare back some of the yearly detractions.

In the UK, stocks reversed November’s positive performance, diminishing fourth quarter returns close to flat. Despite some modest gains in smaller companies’ stocks, the revelation that the UK economy unexpectedly shrank by 0.1% in October, marking a second consecutive monthly contraction, was a setback for inflows to UK-focussed ETFs and, in turn, the majority of FTSE All-Share companies. With UK CPI inflation also rising for a second consecutive month, UK markets may be facing additional constraints to spending and investment, key drivers of economic growth, as we move into 2025.

The macro picture also remains mixed for other European markets, which were somewhat choppy in December, with inflation risks and uncertainty surrounding the pace of central bank easing limiting gains. Central bank policy updates signalled that while monetary policy remains on an easing path, the pace of rate cuts may be slower than previous expectations. This, in addition to political uncertainty in major economies like France and Germany, and continued weakness in Eurozone manufacturing PMI data, which has now contracted for 30 consecutive months, leaves Europe’s valuation discount to the US at around 40%. It remains to be seen whether this valuation gap may widen further, or if it is potentially an attractive entry point.

In fixed income, bond prices took a hit from a reassessment of the inflation and interest rate backdrop, with 10-year yields rising across the UK, US, and Europe. This also impacted returns for UK Real Estate Investment Trusts, with selling pressure resulting in discounts continuing to widen.

Broad commodities saw a positive return in December, largely influenced by the oil price gaining 3.6% The crude oil market has now been fluctuating back and forth within in a ~$20 range for the previous two months, with ongoing supply concerns in the Middle East and Ukraine offset by lower demand and the expectation for further US-led supply under President Trump.

Despite being flat over the month, gold claimed its place as the strongest asset class over 2024, returning 29.4%. As a non-interest-bearing asset with much slower supply growth than fiat currencies, the current environment of a strengthening US dollar together with the growing belief that ‘risk-free’ rates will remain higher-for-longer under a slower than anticipated central bank rate cutting cycle may continue to prove a headwind for gold short-term. This consolidation is still somewhat healthy, however, as it was reaching overbought territory in October, and long-term demand drivers such as central bank stockpiling remain in place.

Although we are vigilant to the developing risks in global markets, our central thesis and the essence of our investment approach are unchanged. We believe that an investment process that is centred around fundamental analysis, but also accounts for potential macroeconomic risks through purposeful diversification, should be best placed to deliver attractive risk-adjusted returns. Our bond allocations continue to serve a purpose as protection against growth shocks while providing attractive yields again. We also believe real assets such as commodities continue to play an important role as protection against inflation shocks. Within equities, we are mindful of concentration risk, the potential for excessive optimism and higher premiums in certain areas of the market. Although valuations are not always a useful timing tool, history has repeatedly reminded investors that the price you pay matters.

The value of your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.