N.B. All performance details are in GBP terms unless otherwise stated.

Global Market Review – March 2025

Market insights

3 min read

Global Market Review – March 2025

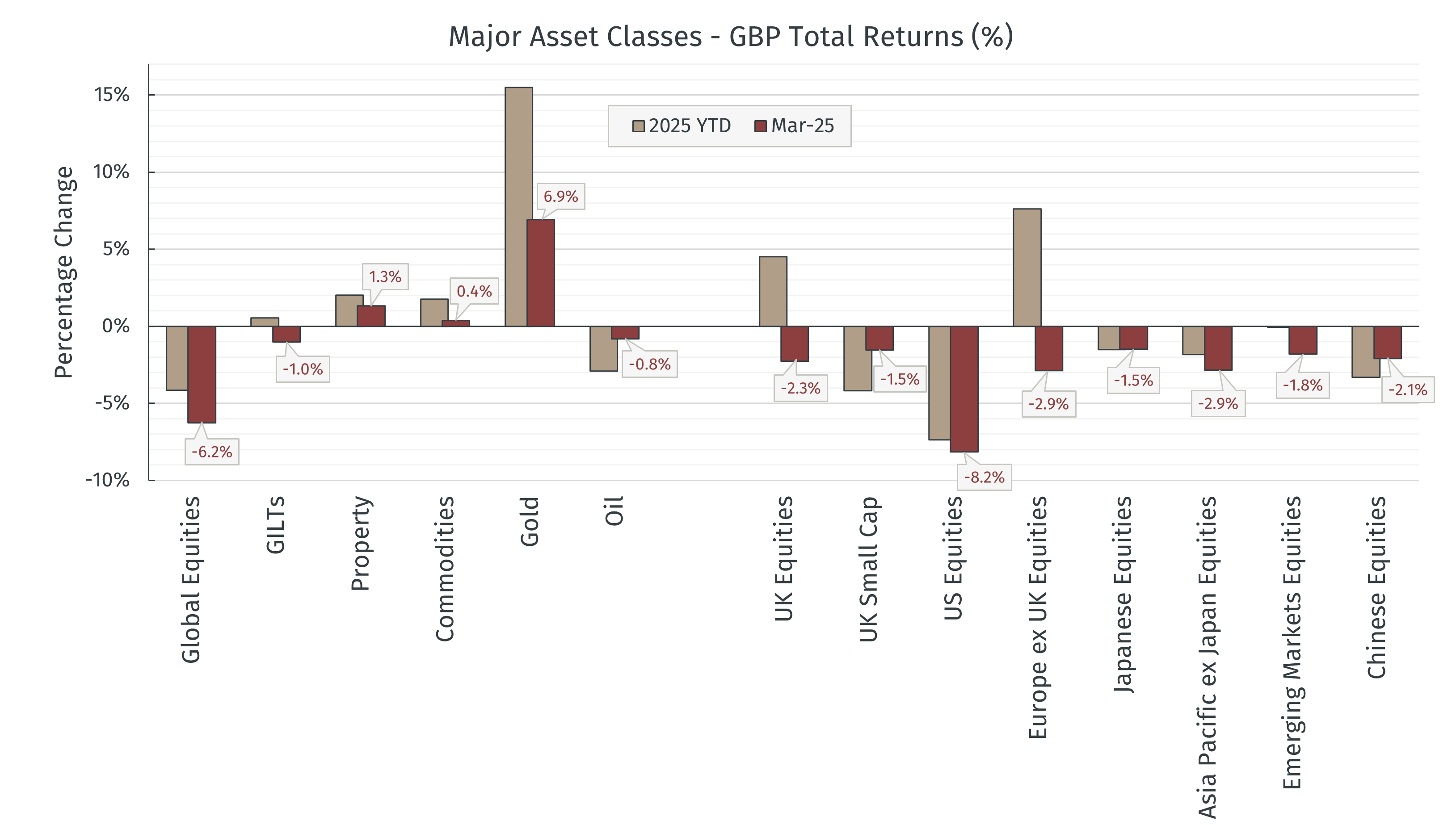

Worries that plagued US equity markets in February spread to other areas throughout March, as concerns intensified over the potential impact that President Trump’s reciprocal trade tariffs might have on the global growth and inflation outlook.

Source: LSEG Data & Analytics via EFG Asset Management, 01 April 2025

Negative performance from the US market, which remains a 65% weight in the global index, led global equity declines for the second straight month. The S&P 500 suffered its largest one-month decline since December 2022, and the Nasdaq 100 delivered its worst quarterly return since Q2 2022. Mega-cap technology names comprise the largest weightings in each index and were hit hard by fears that companies may be pulling back on data centre infrastructure spending commitments. Companies such as Meta (-15.86%), NVIDIA (-15.36%), Amazon (-12.57%), and Alphabet (-11.41%) all suffered double digit declines.

The risk of stagflation, being the potential scenario of a contraction in growth alongside an uptick in inflation, is front of mind of many market participants. Kristalina Georgieva, Managing Director of the International Monetary Fund mentioned in a recent Reuters interview that while they are not currently anticipating a US recession, uncertainty surrounding Trump’s trade tariffs risks dampening growth projections as they are seeing indications that consumer and investor confidence is weakening, and their research showed that the longer uncertainty drags on, the more it may negatively impact growth.

Equity markets hate uncertainty. We believe in this environment of increased volatility is important to take a step back and focus on company fundamentals and we would expect this headline-driven market to create fruitful opportunities for active investors. It is particularly difficult to consistently predict macroeconomic variables such as policy decisions accurately, not least because these are decisions made by human beings in dynamic and high-stakes scenarios. For example, although we favour a focus on market fundamentals over policy predictions, a pivot from the Trump administration towards pro-growth measures cannot be ruled out. With mid-term elections not that far on the horizon, one could reason that many Republicans wouldn’t want to see their seats at risk, and increasingly insular policies that risk causing undue amounts of short-term pain in the hope of longer-term gain might not prove popular with the electorate.

Europe, despite also detracting over the month, remains the best performing equity region year-to-date. Relative valuations remain attractive in multiple sectors, though caution remains over the Eurozone’s economic outlook in the face of trade tariffs. Large-cap UK equities were also still positive over the first quarter, despite seeing a 2.3% detraction in March. Speculation around what proved to be a relatively uninfluential Spring budget statement from Chancellor Reeves distracted away from a series of gradually improving UK economic data, with inflation, PMI data, consumer confidence, and mortgage approvals all coming in better than expected.

Moves in UK gilt yields were somewhat muted compared to those seen in October following the Chancellor’s previous Autum statement. The benchmark 10-year gilt briefly rose to 4.82% on 27 March but has since fallen back to around the 4.54% level. Traders have increased their bets on further interest rate cuts from the Bank of England, with the probability of a 0.25% rate cut at the next monetary policy meeting in May has rising to around 75%.

Asia and Emerging Market equities also fell over the month as sharp declines in the final few days wiped out what had previously been a fair month for many areas. Exporters with high US revenue exposures were hit worst, such as automakers in Japan and South Korea, and Taiwanese semiconductor manufacturers. There were pockets of positivity though, such as India, whose financial and industrial names were seen to be relatively sheltered from tariff impacts, attracting the return of foreign investment after months of outflows.

China’s outlook remains dependent on a mixture of its export activity and stimulus measures to boost its home economy. While economic data for the first two months of the year showed some improvement, other readings such as a rise in unemployment, lower house prices, and poor credit data suggest that a structural economic recovery has still yet to fully take hold.

Property returns were generally positive, with several REITs seeing large share price re-ratings after either receiving takeover bids or announcing sale processes. The likes of Care REIT, Warehouse REIT, and Life Science REIT all posited gains of more than 30% for the month.

Gold continued its surge, rising a further 6.9%, up 15.5% year-to-date. Concerns around global inflation and growth, combined with rate cut expectations, continued central bank purchasing, and resilient demand for gold-backed ETFs all helped push the commodity to new all-time highs. This performance buoyed broad-basket commodity indices and offset FX effects on oil and other USD-based materials which were impacted by the pound strengthening relative to the dollar.

At the time of writing, we are continuing to see market volatility as President Trump’s initial tariff levels have just been announced – an immediate 25% tariff on all foreign automobile imports, a base level of 10% on imports from all countries to take effect from 05 April, with a variety of higher country specific levies coming into place on 09 April. There is still the potential for further negotiations, certain sector exemptions, or even retaliations from other countries to take place. The exact level of tariffs that may actually end up being implemented, and for what length of time, and what impacts they might have on growth, inflation, and the strength of the US dollar still remain uncertain.

Thinking long-term, it is interesting to note that the latest poll by the American Association of Individual Investors (AAII) is currently signalling levels of negative sentiment last seen in 2022 and early 2009 before that. Although it is only one measure, this poll has historically proven to be a favourable contrarian buy signal, and with the valuations of many US stocks having continued to elevate over the past couple of years, it could be argued that a short-term correction was overdue and is somewhat healthy for the market as a whole. We feel that, as with most things, the truth is somewhere in the middle and we remain cognisant of balancing macro risks with attractive fundamentals-driven investment opportunities.

Your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.