N.B. All performance details are in GBP terms unless otherwise stated.

Market insights

2 min read

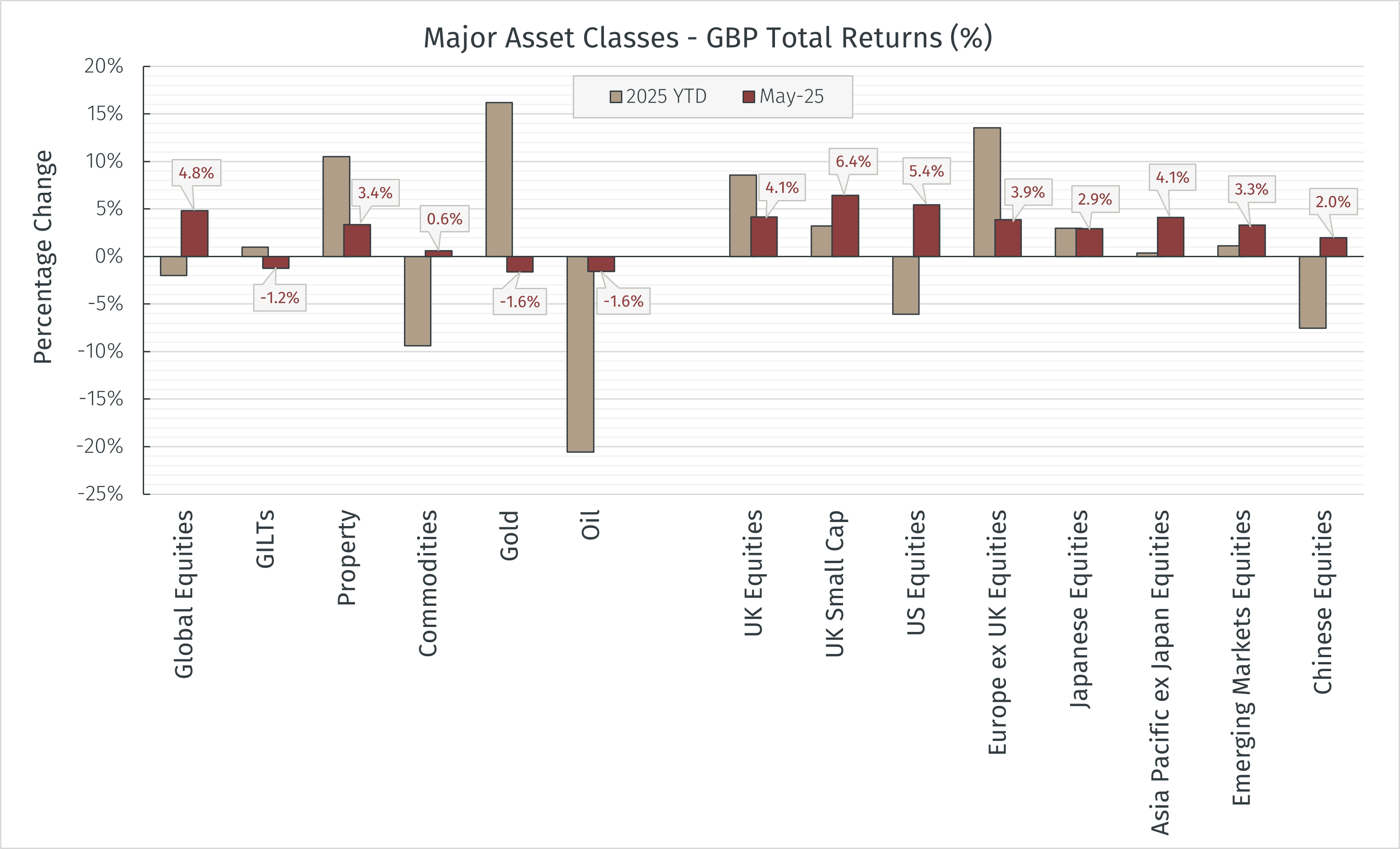

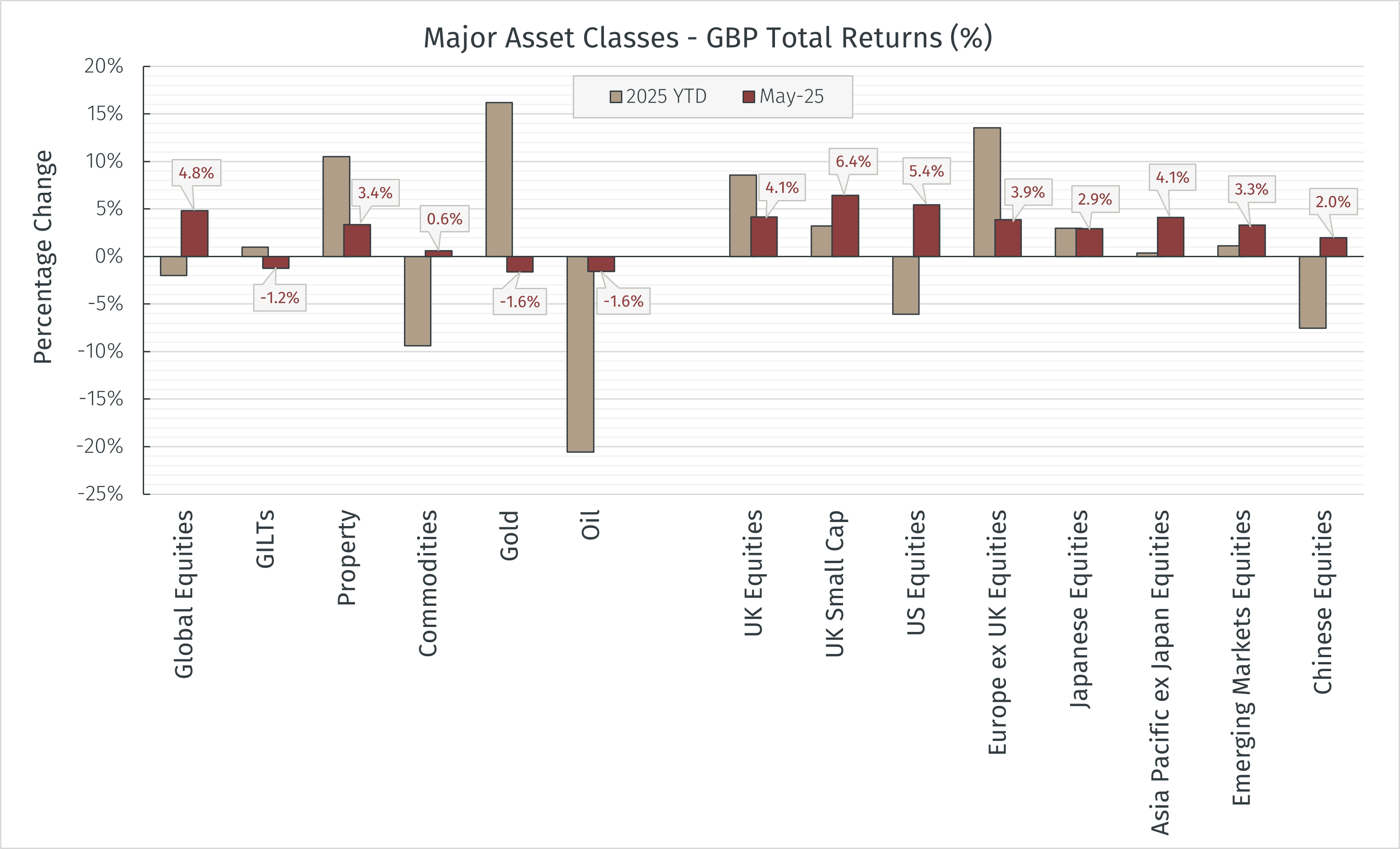

May saw Global equites post their strongest monthly GBP returns in 6 months, as a broad-based tariff relief rally which began in the second half of April continued its momentum.

N.B. All performance details are in GBP terms unless otherwise stated.

All major equity regions saw positive returns last month as improving investor risk sentiment led growth equities to outperform more defensive names. The US equity market made many headlines, with the S&P 500 index posting its best monthly return since November 2023, driven by strong performance in the technology, communication services, consumer discretionary and industrial sectors.

While May’s US equity performance was a welcome reversion of the trend seen in the early part of 2025, it did not come at the expense of other regions, notably Europe and the UK which continued their relative outperformance year-to-date. In particular, UK small-caps were a notable performer, buoyed by multiple factors including last month’s Bank of England interest rate cut, a new UK/EU agreement to reset its relationship 5 years after the initial Brexit deal, and the International Monetary Fund upgrading the UK’s 2025 growth forecast to 1.2% following data showing the UK was the fastest growing G7 economy over the first three months of the year.

Almost all Asia Pacific and Emerging Market equity indices rose in May with the strongest returns seen in areas with high exposure to technology and export-related sectors. Markets in South Korea, Indonesia, Australia, and New Zealand all saw strong performance on the back of central bank interest rate cuts with further cuts expected ahead. Japan’s TOPIX index gained 2.9%, returning to the level it was at before its sharp decline began at the end of March. Chinese indices saw gains as the political administrations in the US and China agreed to substantially cut tariffs on each other’s goods for 90 days from 12 May.

In fixed income markets, prices in many major treasury bonds declined during May as yields in UK, US, German, and Japanese sovereign bond all rose. The reasons for these moves varied – some movement can be attributed to a move back into riskier assets, Japanese yields spiked over excess supply concerns from fiscal spending programmes ahead of upcoming elections, while US Treasuries were influenced by an increasingly hawkish outlook from the central bank’s Federal Open Market Committee, and budget & deficit concerns leading influential ratings agency Moody’s to downgrade the country’s credit rating from AAA to Aa1.

In the UK, the 2-year Gilt yield ended the month at 4.02% and the 10-year Gilt at 4.65%, both impacted by a firmer-than-expected inflation print combined with the narrow decision to cut interest rates during the Bank of England’s latest Monetary Policy Committee meeting. Despite the uptick in bond yields, property remained a favoured asset class. Sustained underlying rental dynamics saw UK-listed Real Estate Investment Trusts continuing to show strength, the index gaining a further 3.4% to take year-to-date returns above the 10% mark.

Within commodities, the return of risk-on sentiment which boosted equities has seen gold plateau somewhat, the metal having traded in the US$3200-3400 range since mid-April. Oil moved lower again, but the decline was much less severe than the move seen in April. As expected, on 31 May OPEC+ took the decision to further raise output in July, however the announced level of 411 thousand barrels per day was lower than feared, helping to support the oil price around the US$61 level.

Looking forward, the Global macroeconomic backdrop remains positive overall but still delicate in many areas. The US Treasury yield curve, despite remaining volatile, is generally trending in a steeper direction, which usually supports market sentiment as steepening generally forecasts growth ahead. Corporate credit spreads in most developed economies are still close to 10-year lows, suggesting markets are not seeing any real signs of stress in corporate finances, and inflation continues to trend in the right direction, albeit slowly in some areas.

Despite these positives, uncertainty around US tariffs remains an overhang, with no further trade agreements made since the UK/US announced their initial framework on 08 May. While an extension to the current 90-day pause remains a possibility, nothing is guaranteed, and the longer any uncertainty continues the larger potential economic impact it might have as companies are more likely to delay hiring and investment decisions until a clearer picture emerges.

What is encouraging though, is observing the way markets and asset class correlations are behaving in between bouts of macro-driven volatility. Q1 corporate earnings were above average in many areas, and while projections for Q2 are lower than were expected at the start of the year, they still remain positive overall. There appears to be a greater focus on fundamentals when it comes to individual share price movements, traditional bond/equity correlations are being exhibited, and supply/demand dynamics remain the key focus for commodity assets.

In this environment we continue to believe in a relatively balanced asset allocation, while remaining prepared to be nimble to opportunities that may present themselves. We continue to be positive on UK, Europe, Asian and Emerging Market equities, remaining neutral in fixed income with a 3- to 5-year defensive positioning preferred.

Your investment can fall as well as rise in value, and the income derived from it may fluctuate. You might get back less than you invest. Currency exchange rate fluctuations can also have a positive and negative affect on your investments. Please note that EFG Harris Allday does not provide tax advice. Past performance is not a reliable indicator of future performance.